NRG Metals Inc. (OTCQB:NRGMF) (TSX-V:NGZ)

Breaking News & Commentary

September 21, 2018

NRG METALS - SECOND PUMP

WELL/POTENTIAL PRODUCTION WELL AT HOMBRE MUERTO NORTH - MAIDEN RESOURCE ESTIMATE

EXPECTED SHORTLY

Vancouver, British Columbia - September 21, 2018 - NRG Metals Inc.

(TSX-V: NGZ) (OTCQB:

NRGMF) (Frankfurt: OGPN)

The Company is pleased to announce the completion of a second pumping well at

the Hombre Muerto North Lithium Project, Salta, Argentina. The well, designated

TWW18-02, was drilled to the target depth of 400 meters, and it is located

immediately adjacent to core hole TH18-02, which was described in the company’s

press releases dated July 10, 2018 and August 23, 2018. Pumping tests will

commence shortly.

Pumping well TWW18-02 was drilled adjacent to core hole TH18-02 on the western

side of the Tramo concession. The core hole was drilled to a depth of 281

meters, and the arithmetic average of single packer, double packer and one

bailer sample from surface to a depth of 230.5 meters was 638 mg/L with a low Mg

to Li ratio of 2.65 to one. Host rocks were mainly poorly-consolidated sandstone

from surface to 77 m, followed by compact halite from 77 to 139 m, poorl y-consolidated

sandstone from 139 to 166 m and then intercalated halite and sandstone to the

bottom of the hole. The results from the pumping well were consistent with the

core hole. y-consolidated

sandstone from 139 to 166 m and then intercalated halite and sandstone to the

bottom of the hole. The results from the pumping well were consistent with the

core hole.

As we reported in our press release dated June 28, 2018, the arithmetic average

of all samples (single packer) for TH18-01 from the surface to a depth of 401

meters was 900 mg/L with a low magnesium to lithium ratio of 3.0 to one. Host

rocks were almost entirely poorly-consolidated sandstone and conglomerate.

Pumping well TWW18-01 was drilled adjacent to core hole TH18-01, and the results

from the pumping well were consistent with the core hole. Initial pumping tests

from TWW18-01 indicated an average pumping rate of 25 liters per second of

brine, but the capacity of the pump was limited, and we expect that this rate

will be exceeded with a larger pump. TH18-01 and TWW18-01 are located on the

eastern side the Tramo concession approximately 2.1 kilometers from hole TH18-02

and TWW18-02.

Two bulk samples of brine have been collected from pumping well TH18-01 for

technical evaluation. A 200 liter sample has been shipped to the Company’s

strategic partner Chengdu Chemphys Chemical Industry Co., Ltd, (“Chemphys”),

located in Chengdu, China. Chemphys, along with Sunresin New Materials Co. Ltd.

, Xi’an, located in Shaanxi, China, are evaluating the brine for new recovery

applications. A large bulk sample has also been collected via tanker truck by

Alex Stewart Laboratories, located in Jujuy, Argentina, to evaluate and optimize

magnesium removal.

NRG’s technical advisor, Montgomery and Associates of Santiago, Chile, is

preparing a maiden resource estimate compliant to National Instrument 43-101, as

part of a technical report for the Hombre Muerto North project, which will be

completed and announced shortly.

On behalf of the board of directors of NRG Metals Inc.,

Adrian F. C. Hobkirk, President and C.E.O.

Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk

714.316.3272 ahobkirk@nrgmetalsinc.com

The preparation of this press release was supervised by Mr. William Feyerabend,

a Certified Professional Geologist and a Qualified Person under NI 43-101. Mr.

Feyerabend approves of the technical and scientific disclosure contained in this

press release.

The TSX Venture Exchange has not reviewed the content of this news release and

therefore does not accept responsibility or liability for the adequacy or

accuracy of the contents of this news release.

This news release contains certain “forward- looking statements” within the

meaning of Section 21E of the United States Securities and Exchange Act of 1934,

as amended. Except for statements of historical fact relating to the Company,

certain information contained herein constitutes forward- looking statements.

Forward-looking statements are based upon opinions and estimates of management

at the date the statements are made, and are subject to a variety of risks and

uncertainties and other factors which could cause actual results to differ

materially from those projected in the forward looking statements. The reader is

cautioned not to place undue reliance on forward- looking statements. The

transaction described in this news release is subject to a variety of conditions

and risks which include but are not limited to: regulatory approval, shareholder

approval, market conditions, legal due diligence for claim validity, financing,

political risk, security risks at the property locations and other risks. As

such, the reader is cautioned that there can be no guarantee that this

transaction will complete as described in this news release. We seek safe

harbor.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F.C. Hobkirk

President and C.E.O.

Media Contact:

Investors / Shareholders

T:+1-855-415-8100

Adrian Hobkirk

T: +1-714-316-272

E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

SOURCE NRG Metals Inc.

NRG Announces Additional

Results for Second Drill Hole at its Flagship Hombre Muerto North Lithium

Project Second Pumping Well Started

NRG's second drill hole at the Hombre Muerto North project has been

completed to a depth of 280.8 m, and the sample results demonstrate that

excellent lithium values are present in the lower portion of the hole.

Based on these encouraging results, as well as the excellent results from

the pumping well located approximately 2.1 kilometers to the east, NRG has

decided to drill a second pumping well adjacent to the second core hole. The

target depth of this hole is 400 m.

Vancouver, British Columbia - August 23, 2018 - NRG Metals Inc.

(TSX-V: NGZ) (OTCQB:

NRGMF) (Frankfurt: OGPN)

is pleased to report additional assays from the second diamond drill hole at the

Hombre Muerto North lithium project. The samples were taken from depths ranging

from 91.0 to 230.5 m below surface, and these assays range from 779 to 507 mg/L

lithium with low Mg to Li ratios ranging from 2.3 to 3.0. The average for the

entire hole is 638 mg/L Lithium with a Mg to Li ratio of 2.65 to 1.0. The assay

results for the additional samples are shown in the following table.

Host rocks are mainly poorly-consolidated sandstone from surface to 77 m,

followed by a layer of compact halite from 77 to 139 m, poorly-consolidated

sandstone from 139 to 166 m, and then intercalated halite and sandstone to 230.5

meters. The sample interval is not regular because it was difficult to collect

samples due to caving of the hole. Nevertheless, these results confirm that brine containing high lithium grades is present from the

surface to a depth of at least 230 m, the depth of the deepest sample.

results confirm that brine containing high lithium grades is present from the

surface to a depth of at least 230 m, the depth of the deepest sample.

Based upon these encouraging results, management decided to drill a second

pumping well adjacent to this core hole. Equipment has been moved into place,

and the contractor has commenced drilling to an anticipated target depth of 400

meters.

Jose de Castro, COO of NRG Metals Inc., commented, "We are extremely

enthusiastic about the diamond drilling results, as well as the results from the

pumping well. These results demonstrate the presence of high-grade lithium

bearing brine across the breadth of our Tramo property. We look forward to

completing the second pumping well and to fast tracking the project to

production."

The sampling was conducted with double packer equipment over 1.0- to 1.5-m

intervals, and the final sample from 228.5 to 230.5 m was collected using a

bailer sampling device. Onsite QA/QC for the sampling was directed by Cristian

Avila of Montgomery and Associates of Santiago, Chile under the supervision of

Mike Rosko, also of Montgomery and Associates, a Qualified Person under NI

43-101. The samples were assayed by the Alex Stewart Laboratory in Jujuy,

Argentina, which is the preeminent laboratory for lithium brine analysis in

northern Argentina. Alex Stewart employed Inductively Coupled Plasma Optical

Emission Spectrometry ("ICP-OES") as the analytical technique for the primary

constituents of interest, including those shown in the table. Alex Stewart

maintains a strict internal QA/QC program employing multiple standards,

re-analyses by AA and calculation of ionic balances. NRG inserted one blank

sample and one blind duplicate samples in the sample batch; all QA/QC results

corroborate the analyses reported in this press release. In addition to the

packer brine samples, sealed core samples have been collected, and these samples

will be sent to a laboratory in the United States for brine release testing.

The project is located in the province of Salta, Argentina at the northern end

of the prolific Hombre Muerto Salar, adjacent to FMC's producing Fenix mine and

the Sal de Vida development stage project being developed by Galaxy Resources

Ltd.

About the Company

NRG Metals Inc. is an exploration stage company focused on the advancement of

lithium brine projects in Argentina. NRG Metals Inc. currently has approximately

132 million shares issued and outstanding, and trades on the TSX Venture

Exchange under symbol NGZ, on the OTC QB Market under symbol NRGMF, and on the

Frankfurt Stock Exchange under symbol OGPN.

Technical Disclosure

The preparation of this press release was supervised by Mr. Michael J. Rosko, a

registered professional geologist in the states of Arizona (25065), California

(5236), and Texas (6359), and a registered member of Society for Mining,

Metallurgy, and Exploration (#4064687) and a Qualified Person as defined under

National Instrument 43-101 with over 30 years of experience, with 10 years of

direct experience with lithium brine deposits. Mr. Rosko approves the scientific

and technical disclosure contained in this press release.

The TSX Venture Exchange has not reviewed the content of this news release and

therefore does not accept responsibility or liability for the adequacy or

accuracy of the contents of this news release.

This news release contains certain "forward-looking statements" within the

meaning of Section 21E of the United States Securities and Exchange Act of 1934,

as amended. Except for statements of historical fact relating to the Company,

certain information contained herein constitutes forward-looking statements.

Forward-looking statements are based upon opinions and estimates of management

at the date the statements are made and are subject to a variety of risks and

uncertainties and other factors which could cause actual results to differ

materially from those projected in the forward-looking statements. The reader is

cautioned not to place undue reliance on forward-looking statements. We seek

safe harbor.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F.C. Hobkirk

President and C.E.O.

Media Contact:

Investors / Shareholders

T:+1-855-415-8100

Adrian Hobkirk

T: +1-714-316-272

E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

SOURCE NRG Metals Inc.

NRG Announces Excellent

Pumping Well Test Results at

Flagship Hombre Muerto North Lithium Project

Vancouver, British Columbia - August 9, 2018 - NRG Metals Inc.

(TSX-V: NGZ) (OTCQB:

NRGMF) (Frankfurt: OGPN)

the Company is pleased to report pumping test results for the first 10 inch

large-diameter pumping well at the Hombre Muerto North Lithium Project,

Argentina. The well is located on the Tramo Claim portion of the project group.

This pumping well was drilled immediately adjacent to our first exploration

diamond core hole following the excellent results from the recent sampling that

provided assay results of 401 meters of 900 mg/L lithium with very good

chemistry as reported in the Company’s press release dated June 28, 2018.

Together with information from the diamond core drilling program, data from the

pumping test will be used to calculate resources and reserves for the project.

If warranted, this pumping well can be used for production as part of our

fast-track development of the project.

NRG Metals completed a 72-hour pumping test that produced 26 liters per second

of brine. The test was limited by the capacity of the pump causing our test to

rapidly reach the limits of the pumping equipment and measurement devices at the

site. The pumping test was designed and monitored by our independent technical

consultants, Montgomery & Associates of Santiago, Chile.

Based on these positive initial pump test results, our technical team believes

that the well could have significant additional pumping capability. The Company

is planning to mobilize additional equipment to run a test with a higher

capacity pumping system as soon a possible.

Josť de Castro, Chief Operating Officer of NRG Metals Inc., commented, “we are

very pleased with the results of the pumping test at Hombre Muerto North. These

results have removed a significant part of the risk associated with developing a

lithium operation. We are seeing exceptionally high grades in clastic host rocks

with good permeability, and the brine chemistry is very favorable. The Hombre

Muerto North brine is unsaturated and has low sulfate and magnesium ratios.

Brine with these characteristics has the potential to evaporate more quickly

while using less pond area than would be the case for a typical saturated brine

and will require lower consumption of chemical reagents potentially resulting in

diminished capital and operating costs.”

The project is located in the province of Salta, Argentina at the northern end

of the prolific Hombre Muerto Salar, adjacent to FMC’s producing Fenix mine and

the Sal de Vida development stage project owned by Galaxy Resources Ltd. Galaxy

recently drilled a brine pumping well on their property which is adjacent and

contiguous to the south of the NRG Tramo claim. Galaxy has also announced it has

entered into a letter agreement for the sale of their northern portion of the

Sal de Vida project to the Korean lithium producer POSCO for US$280 million (

subject to third quarter POSCO board approval ). The sale includes that portion

of the salar which surrounds the NRG Metals Tramo claim.

About the Company

NRG Metals Inc. is an exploration stage company focused on the advancement of

lithium brine projects in Argentina. In addition to the Hombre Muerto North

project, the Company is evaluating its 29,000-hectare (72,000 acre) Salar

Escondido project in Catamarca province where the company recently completed a

400-meter rotary hole, as described in the Company’s press release dated June

27, 2018.

NRG Metals Inc. currently has approximately 132 million shares issued and

outstanding, and trades on the TSX Venture Exchange under symbol NGZ, on the OTC

QB Market under symbol NRGMF, and on the Frankfurt Stock Exchange under symbol

OGPN.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F.C. Hobkirk President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk

714.316.3272

E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

Technical Disclosure

The preparation of this press release was supervised by Mr. William Feyerabend,

a Certified Professional Geologist and a Qualified Person under NI 43-101. Mr.

Feyerabend approves of the technical and scientific disclosure contained in this

press release.

The TSX Venture Exchange has not reviewed the content of this news release and

therefore does not accept responsibility or liability for the adequacy or

accuracy of the contents of this news release.

This news release contains certain “forward-looking statements” within the

meaning of Section 21E of the United States Securities and Exchange Act of 1934,

as amended. Except for statements of historical fact relating to the Company,

certain information contained herein constitutes forward-looking statements.

Forward-looking statements are based upon opinions and estimates of management

at the date the statements are made and are subject to a variety of risks and

uncertainties and other factors which could cause actual results to differ

materially from those projected in the forward-looking statements. The reader is

cautioned not to place undue reliance on forward-looking statements. We seek

safe harbor.

Adrian F.C. Hobkirk President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk

714.316.3272 E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

SOURCE NRG Metals Inc.

NRG Announces Initial Results

for Second Drill Hole at Its Flagship Hombre Muerto North Lithium Project

HIGHLIGHTS

•

Initial sample results for the

second core hole indicate excellent lithium values with very low Mg/Li ratios.

The arithmetic average of three samples taken to a depth of 61.5 m is 719 mg/l

lithium with a magnesium to lithium ratio ranging from 2.1 to 3.3

Vancouver, British Columbia - July 10, 2018 - NRG Metals Inc.

(TSX-V: NGZ) (OTCQB:

NRGMF) (Frankfurt: OGPN)

is pleased to report the

initial assays for samples from the second diamond drill hole at the Hombre

Muerto Lithium project. The samples were taken from near surface to a depth of

61.5 m below surface. The samples average 719 mg/L lithium with a very low Mg to

Li ratio ranging from 2.1 to 3.3. These values are similar to the results

obtained in the first diamond drill hole located 2.1 kilometers to the east. The

assays results are shown in the table below.

Drilling in this hole has advanced to a depth of 226.5 m with a planned depth of

400 m. Host rocks are mainly poorly-consolidated sandstone from surface to 77 m,

followed by a layer of compact halite from 77 to 139 m, poorly-consolidated

sandstone from 139 to 166 m, and then intercalated halite and sandstone to the

current bottom of the hole at 226.5 m.

Adrian Hobkirk, CEO of NRG Metals Inc., commented, "We are encouraged to find

high lithium grades in the first part of the second hole, and these results

demonstrate the presence of lithium bearing brine across our Tramo property. We

will have a more complete picture once this hole is completed and when we have

the results of the pumping test from the large diameter hole completed adjacent

to the first core hole."

The sampling was conducted with single packer equipment over 1.0 to 2.5 m

intervals approximately every 20 meters. Brine is present from the surface and

below the elevation of the last sample reported from 59.0 to 61.5 m. NRG

believes that the three samples taken together are representative of the brine

material from surface to at least 61.5 m. NRG considers that the host rock

stratigraphy is horizonal, and the sampled interval represents the true

thickness because the drill hole is vertical. Onsite QA/QC for the sampling was

directed by Cristian Avila of Montgomery and Associates of Santiago, Chile under

the supervision of Mike Rosko, also of Montgomery and Associates, a Qualified

Person under NI 43-101. The samples were assayed by the Alex Stewart Laboratory

in Jujuy, Argentina, which is the preeminent laboratory for lithium brine

analysis in northern Argentina. Alex Stewart employed Inductively Coupled Plasma

Optical Emission Spectrometry ("ICP-OES") as the analytical technique for the

primary constituents of interest, including those shown in the table. Alex

Stewart maintains a strict internal QA/QC program employing multiple standards,

re-analyses by AA and calculation of ionic balances. NRG inserted one blank

sample and one blind duplicate sample in the samples batch; all QA/QC results

corroborate the analyses reported in this press release. In addition to the

packer brine samples, sealed core samples have been collected, and these samples

will be sent to a laboratory in the United States for brine release testing.

The project is located in the province of Salta, Argentina at the northern end

of the prolific Hombre Muerto Salar, adjacent to FMC's producing Fenix mine and

the Sal de Vida Lithium Project being developed by Galaxy Resources Ltd. Galaxy

recently announced the pending sale of their northern portion of Sal de Vida to

POSCO of South Korea, for $ US 280 million.

About the Company

NRG Metals Inc. is an exploration stage company focused on the advancement of

lithium brine projects in Argentina. NRG Metals Inc. currently has approximately

132 million shares issued and outstanding, and trades on the TSX Venture

Exchange under symbol NGZ, on the OTC QB Market under symbol NRGMF, and on the

Frankfurt Stock Exchange under symbol OGPN.

Technical Disclosure

The preparation of this press release was supervised by Mr. Michael J. Rosko, a

registered professional geologist in the states of Arizona (25065), California

(5236), and Texas (6359), and a registered member of Society for Mining,

Metallurgy, and Exploration (#4064687) and a Qualified Person as defined under

National Instrument 43-101 with over 30 years of experience, with 10 years of

direct experience with lithium brine deposits. Mr. Rosko approves the scientific

and technical disclosure contained in this press release.

The TSX Venture Exchange has not reviewed the content of this news release and

therefore does not accept responsibility or liability for the adequacy or

accuracy of the contents of this news release.

This news release contains certain "forward-looking statements" within the

meaning of Section 21E of the United States Securities and Exchange Act of 1934,

as amended. Except for statements of historical fact relating to the Company,

certain information contained herein constitutes forward-looking statements.

Forward-looking statements are based upon opinions and estimates of management

at the date the statements are made and are subject to a variety of risks and

uncertainties and other factors which could cause actual results to differ

materially from those projected in the forward-looking statements. The reader is

cautioned not to place undue reliance on forward-looking statements. The

transaction described in this news release is subject to a variety of conditions

and risks which include but are not limited to: regulatory approval, shareholder

approval, market conditions, legal due diligence for claim validity, financing,

political risk, security risks at the property locations and other risks. As

such, the reader is cautioned that there can be no guarantee that this

transaction will complete as described in this news release. We seek safe

harbor.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F.C. Hobkirk President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk

714.316.3272 E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

SOURCE NRG Metals Inc.

NRG Announces Complete Results

for First Drill Hole at its Flagship Hombre Muerto North Lithium Project

HIGHLIGHTS

•

Brine samples collected from 300 to

401 meters (m) show high grade values very similar to the assays previously

reported for the samples from surface to a depth of 300 m, with an arithmetic

average 918 mg/l lithium and a low magnesium to lithium ratio.

•

The arithmetic average lithium

concentration for all of the samples from the surface to a depth of 401 m is 900

mg/l, with a relatively low magnesium to lithium ratio of 3.0 to 1.0.

•

Adjacent rotary drill hole for pump

testing has been completed to a depth of 393 m and pump testing will commence

shortly.

•

Drilling on a second core hole

located 2.1 kilometers to the west of the first hole is advancing.

Vancouver, British Columbia - June 29, 2018 - NRG Metals Inc.

(TSX-V: NGZ) (OTCQB:

NRGMF) (Frankfurt: OGPN)

the Company is pleased to report that assays for double packer samples collected

over the interval from 300 to the bottom of the first hole at a depth of 401 m.

The samples for this interval average 918 mg/L lithium with a relatively low Mg

to Li ratio of 3.0 to 1.0. These values are very consistent with the assays

received for the samples from surface to a depth of 300 m, and the average for

the entire 400 m hole is 900 mg/L lithium with an average magnesium to lithium

ratio of 3.0.

Drilling is proceeding on a second core hole located approximately 2.2

kilometers to the west of the first core hole. As of June 26, the hole had

advanced to a depth of 208.0 m. Poorlyconsolidated sandstone similar to what was

drilled in the first core hole was encountered to a depth of 77 m, followed by a

layer of compact halite before passing back into mostly poorly-consolidated

sandstone from 139 m to the bottom of the hole. Drilling is continuing, although

the rate of advance has been slowed by the poorly-consolidated nature of the

clastic sediments.

Josť de Castro, Chief Operating Officer of NRG Metals Inc., commented "We are

very enthusiastic about the results at Hombre Muerto North. We are seeing

exceptionally high grades in a clastic host rock that appears to have good

permeability, and the brine chemistry is very favorable. The production of

lithium from brine involves concentration of lithium contained in the brine by

evaporation. The Hombre Muerto brine is unsaturated, which means that it should

be possible to concentrate the brine more quickly using less pond area than

would be the case for a typical saturated brine. Furthermo re,

the sulfate and magnesium ratios are low compared to other salar brines, and

this means that the consumption of lime and other reagents should be relatively

low compared to other lithium projects. These characteristics imply favorable

operating and capital cost profiles, should the economic and technical

feasibility of the project be established." re,

the sulfate and magnesium ratios are low compared to other salar brines, and

this means that the consumption of lime and other reagents should be relatively

low compared to other lithium projects. These characteristics imply favorable

operating and capital cost profiles, should the economic and technical

feasibility of the project be established."

The sampling was conducted with single packer equipment over 1-m intervals,

approximately every 20 meters. On site QA/QC for the sampling was directed by

Cristian Avila of Montgomery and Associates of Santiago, Chile under the

supervision of Mike Rosko, also of Montgomery and Associates, a Qualified Person

under NI 43-101. The samples were assayed by the Alex Stewart Laboratory in

Jujuy, Argentina, which is the preeminent laboratory for lithium brine analysis

in northern Argentina. Alex Stewart employed Inductively Coupled Plasma Optical

Emission Spectrometry ("ICP-OES") as the analytical technique for the primary

constituents of interest, including those shown in the table. Alex Stewart

maintains a strict internal QA/QC program employing multiple standards, re-

analyses by AA and calculation of ionic balances. NRG inserted one blank sample

and three blind duplicate samples in the sample batch, and all QA/QC results

corroborate the analyses reported in this press release. In addition to the

packer samples, sealed core samples have been collected throughout the hole, and

these samples have been sent to a laboratory in the United States for brine

release testing.

The project is located in the province of Salta, Argentina at the northern end

of the prolific Hombre Muerto Salar, adjacent to FMC's producing Fenix mine and

the Sal de Vida development stage project being developed by Galaxy Resources

Ltd.

About the Company

NRG Metals Inc. is an exploration stage company focused on the advancement of

lithium brine projects in Argentina. In addition to the Hombre Muerto Norte

project, the Company is evaluating its 29,000-hectare (72,000 acre) Salar

Escondido project in Catamarca province where the company recently completed a

400-meter rotary hole, as described in the Company's press release dated June

27, 2018.

NRG Metals Inc. currently has approximately 132 million shares issued and

outstanding, and trades on the TSX Venture Exchange under symbol NGZ, on the OTC

QB Market under symbol NRGMF, and on the Frankfurt Stock Exchange under symbol

OGPN.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F.C. Hobkirk

President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk

714.316.3272

E: ahobkirk@nrgmetalsinc.com W: www.nrgmetalsinc.com

Technical Disclosure

The preparation of this press release was supervised by Mr. Michael J. Rosko, a

registered professional geologist in the states of Arizona (25065), California

(5236), and Texas (6359), and a registered member of Society for Mining,

Metallurgy, and Exploration (#4064687) and a Qualified Person as defined under

National Instrument 43-101 with over 30 years of experience, with 10 years of

direct experience with lithium brine deposits. Mr. Rosko approves the scientific

and technical disclosure contained in this press release.

The TSX Venture Exchange has not reviewed the content of this news release and

therefore does not accept responsibility or liability for the adequacy or

accuracy of the contents of this news release.

This news release contains certain "forward-looking statements" within the

meaning of Section 21E of the United States Securities and Exchange Act of 1934,

as amended. Except for statements of historical fact relating to the Company,

certain information contained herein constitutes forward-looking statements.

Forward-looking statements are based upon opinions and estimates of management

at the date the statements are made and are subject to a variety of risks and

uncertainties and other factors which could cause actual results to differ

materially from those projected in the forward-looking statements. The reader is

cautioned not to place undue reliance on forward-looking statements. The

transaction described in this news release is subject to a variety of conditions

and risks which include but are not limited to: regulatory approval, shareholder

approval, market conditions, legal due diligence for claim validity, financing,

political risk, security risks at the property locations and other risks. As

such, the reader is cautioned that there can be no guarantee that this

transaction will complete as described in this news release. We seek safe

harbor.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F.C. Hobkirk

President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk

714.316.3272

E: ahobkirk@nrgmetalsinc.com W: www.nrgmetalsinc.com

SOURCE NRG Metals Inc

NRG Drilling Continues to

Intersect High-Grade Brine at the Hombre Muerto North Lithium Project

HIGHLIGHTS

• Brine

samples collected from 100 meters to 300 meters show high grade values very

similar to the assays for the samples from surface to a depth of 100 meters,

with an arithmetic average 888 mg/l Li and a low Mg to Li ratio.

• The hole has been completed to a depth of 401 meters, and sample results from

300 to the bottom of the hole are pending.

• Adjacent rotary drill hole for pump testing has been completed to a depth of

393 meters. The hole diameter is being enlarged by reaming in order to install

casing for pump testing.

• Drilling has commenced on a second diamond core hole approximately 2.1

kilometers to the east of the first hole

Vancouver, British Columbia - June 14, 2018 - NRG Metals Inc.

(TSX-V: NGZ) (OTCQB:

NRGMF) (Frankfurt: OGPN)

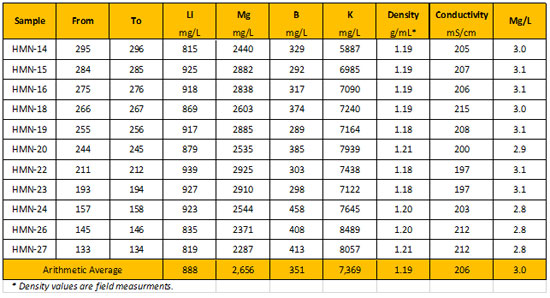

the Company is pleased to report that assays for double packer samples collected

over the interval from 100 to 300 meters of the first core have been received,

and average 888 mg/L lithium with a relatively low Mg to Li ratio of 3.0 to 1.0.

These values are very similar to those returned for the first 100 meters of the

hole, indicating the presence of a remarkably consistent high-grade brine. The

assay results are shown in the table below.

The hole has been completed to the targeted depth of 401 meters, and the drill

has been moved approximately 2.2 kilometers to the east where drilling on a

second core hole is underway. As of June 12, the hole had advanced to a depth of

151 meters mostly in clastic sediments consisting of poorly consolidated

sandstone and conglomerate.

Josť de Castro, Chief Operating Officer of NRG Metals Inc., commented “We are

very excited about the outstanding res ults

from our first hole. The results continue to exceed our expectations. These high

grades and favorable Mg to Li ratios have the potential to have a very positive

impact on any future capital and operating costs should the economic viability

and technical feasibility of the project be established. We are very encouraged

to see the entry of POSCO from South Korea into the Hombre Muerto basin with

their pending $ 280 million purchase of the northern part of the Sal de Vida

lithium project from Galaxy Resources Ltd.” ults

from our first hole. The results continue to exceed our expectations. These high

grades and favorable Mg to Li ratios have the potential to have a very positive

impact on any future capital and operating costs should the economic viability

and technical feasibility of the project be established. We are very encouraged

to see the entry of POSCO from South Korea into the Hombre Muerto basin with

their pending $ 280 million purchase of the northern part of the Sal de Vida

lithium project from Galaxy Resources Ltd.”

The rotary hole located 16 meters east of the core hole has been completed at a

depth of 393 meters, and the diameter is being enlarged by reaming in order to

install perforated casing for pumping tests. If the results warrant, this hole

can be utilized as a production well.

The sampling was conducted with double packer equipment over one-meter intervals

approximately every ten meters depending upon conditions in the hole. Samples

were not collected from some of the intervals below a depth of 160 meters due to

restricted fluid flow. On site QA/QC for the sampling was directed by Cristian

Avila of Montgomery and Associates of Santiago, Chile under the supervision of

Mike Rosko, also of Montgomery and Associates, a Qualified Person under NI

43-101. The samples were assayed by the Alex Stewart Laboratory

in Jujuy, Argentina, which is the preeminent laboratory for lithium brine

analysis in northern Argentina. Alex Stewart employed Inductively Coupled Plasma

Optical Emission Spectrometry (“ICP-OES”) as the analytical technique for the

primary constituents of interest, including those shown in the table. Alex

Stewart maintains a strict internal QA/QC program employing multiple standards,

re-analyses by AA and calculation of ionic balances. NRG inserted one blank

sample and three blind duplicate samples in the sample batch, and all QA/QC

results corroborate the analyses reported in this press release. In addition to

the packer samples, sealed core samples have been collected throughout the hole,

and these samples will be sent to a laboratory in the United States for brine

release testing.

The project is located in the province of Salta, Argentina at the northern end

of the prolific Hombre Muerto Salar, adjacent to FMC’s producing Fenix mine and

Galaxy Resources’ Sal de Vida development stage project.

On behalf of the board of directors of NRG Metals Inc.:

Adrian F.C. Hobkirk

President and C.E.O.

T: Investors / Shareholders Call 855-415-8100 / Direct to Adrian Hobkirk

714.316.3272

E: ahobkirk@nrgmetalsinc.com

W: www.nrgmetalsinc.com

The preparation of this press release was supervised by Mr. Michael J. Rosko, a

registered professional geologist in the states of Arizona (25065), California

(5236), and Texas (6359), and a registered member of Society for Mining,

Metallurgy, and Exploration (#4064687) and a Qualified Person as defined under

National Instrument 43-101. Mr. Rosko approves the scientific and technical

disclosure contained in this press release.

The TSX Venture Exchange has not reviewed the content of this news release and

therefore does not accept responsibility or liability for the adequacy or

accuracy of the contents of this news release.

This news release contains certain “forward-looking statements” within the

meaning of Section 21E of the United States Securities and Exchange Act of 1934,

as amended. Except for statements of historical fact relating to the Company,

certain information contained herein constitutes forward-looking statements.

Forward-looking statements are based upon opinions and estimates of management

at the date the statements are made and are subject to a variety of risks and

uncertainties and other factors which could cause actual results to differ

materially from those projected in the forward-looking statements. The reader is

cautioned not to place undue reliance on forward-looking statements. The

transaction described in this news release is subject to a variety of conditions

and risks which include but are not limited to: regulatory approval, shareholder

approval, market conditions, legal due diligence for claim validity, financing,

political risk, security risks at the property locations and other risks. As

such, the reader is cautioned that there can be no guarantee that this

transaction will complete as described in this news release. We seek safe

harbor.

SOURCE NRG Metals Inc.

China’s Ganfeng Files for IPO

in the Mass Scramble for Lithium

Vancouver, British Columbia -- NRG Metals Inc.

(TSX-V: NGZ) (OTCQB:

NRGMF) (Frankfurt: OGPN)

-

Chinese company Ganfeng Lithium, the country’s largest producer

of battery raw material, threw its hat in the ring recently with the

announcement that it is filing for an Initial Public Offering.

Lithium demand is already a driving force for companies hoping to

tap greater supplies including LSC Lithium Corp. (TSX-V:LSC) (OTC:LSSCF),

Critical Elements Corporation (TSX-V:CRE) (OTC:CRECF),

Lithium Americas

Corp. (NYSE:LAC) (TSX:LAC)

and NRG Metals Inc. (TSX-V:NGZ) (OTC:NRGMF)

The EV revolution is already proving to be an unstoppable force

that will completely revolutionize the transport industry. With that

transformation, lithium is emerging to take the place of petroleum as the king

of the energy industry.

Forecasters are already predicting that the increase in demand by

automakers, power storage systems and new high tech applications will create a

potential significant shortfall and major players are gearing up.

Leading lithium companies are seeing their share values also

increase based on the new demand and outlook for metal including

LSC Lithium

Corp.

(TSXV: LSC.V) (OTC:LSSCF),

Critical Elements

(TSX-V: CRE.V)

(OTC:CRECF),

and

Lithium Americas Corp. (NYSE:LAC)

(TSX:LAC.TO).

NRG

Metals Inc.

(TSX-V:

NGZ)

(OTCMKTS:

NRGMF)

is one of the junior companies making significant exploration progress in South

America. The Company just released drill results from it’s strategically located

Hombre Muerto North Lithium Project, and preliminary test results are exciting.

In addition, NRG is also drilling a 29,000 hectare project called the Salar Escondido. They presently have three drill rigs turning, two at Hombre

Muerto, and one at Salar Escondido.

the Salar Escondido. They presently have three drill rigs turning, two at Hombre

Muerto, and one at Salar Escondido.

GANGFENG LITHIUM A HUGE PLAYER

The scramble for lithium resources, which is already in full

swing, is definitely a race to control the future and China seems to have taken

an early leap ahead of the rest of the pack. Chinese company Ganfeng Lithium,

the country’s largest producer of battery raw material, is seeking to raise $1

billion worth of capital through an initial public offering on the Hong Kong

Stock Exchange.

The company is among a host of miners looking to quickly identify

lithium projects that can be developed into production, in order to meet growing

demand from electric car makers. German carmaker BMW is also reported to be in

the process of signing a lucrative five to ten-year supply deal for lithium and

cobalt as it looks to change its fleet into hybrid and electric cars.

According to insiders familiar with the deal’s unfolding, Ganfeng

could overshoot their target by up to half a billion dollars. The company plans

to use the money to finance acquisitions, further exploration of lithium

reserves and expansion of capacity to meet growing demand of the metal.

The deal is being spearheaded by financer Citi Group.

Ganfeng, which is headquartered in

Shanghai, is the third largest producer of lithium behind American company

Albemarle and SQM of Chile. The company also produces batteries and recycles

lithium from discarded gadgets.

Aside from exploration activities, Ganfeng is contributing to the

EV revolution by developing solid state batteries in which the liquid

electrolyte is replaced with solid lithium metal. These batteries promise faster

charging times and higher driving range, and could also be safer than

conventional li-ion batteries.

Ganfeng could use some of the proceeds from

the IPO to fund Lithium Americas, with whom the company has a $125 million line

of credit and is developing a project in Argentina. Creating lithium production

is their priority.

CREATING CONFIDENCE IN LITHIUM PLAYS.

NRG Metals, a player focused on the exploration and potential

development of lithium brine assets in Argentina, has recently attracted a

Chinese battery material producer, Chemphys Chengdu. Through closing on

a $1.4 million private placement to fund ongoing exploration activities in

Argentina, Chemphys became the largest single shareholder of NRG. In addition,

NRG and Chempys agreed to an off-take agreement on all potential future lithium

production at the Hombre Muerto North project.

NRG Metals has two projects, with the most significant project

being the "Hombre Muerto North Project" or HMNP. HMNP is located in the Salta

and Catamarca provinces within the Hombre Muerto Salar, the location of FMC’s

lithium producing Fenix Mine. The project comprises a total property package of

over 3,000 hectares encompassing six concessions. NRG has two drill rigs

working on this project right now. One is drilling a core hole to test for

lithium grade. The second is drilling a large diameter pumping well hole to test

for flow, if warranted by results. And results from the first 100 meters of the

core hole are in, and quite interesting. The first 100 meters averaged 905

miligrams per liter lithium, with a low magnesium ( a contaminant that needs to

be removed ) to lithium ratio. The NRG lithium team, well experienced in the

exploration and development to production of lithium projects in Argentina, are

very excited by the initial results.

Chief Operating Officer Jose de Castro stated: “We are very excited about

the exceptional results from the initial sampling. The lithium grades and low Mg

to Li ratios exceeded our expectations.

The high grades

and favorable Mg to Li ratios have the potential to have a very positive impact

on any future capital and operating costs should the economic viability and

technical feasibility of the project be established.

Mr. De Castro has

actually mined lithium, having managed the Olaroz Salar to production for

Orocobre, an Australian producer.

Read this most recent News issued by NRG Metals in its

entirety including tables below

LITHIUM STILL VERY ATTRACTIVE

Lithium plays a critical role in the development of rechargeable

batteries, with li-ion varieties being most popular with electronics

manufacturers and EV makers. As demand for use in EV batteries continues to

rise, lithium prices are poised to rise even further due to a constricting

supply.

The price of lithium has already doubled in the last two years

alone and industry experts believe the trend will continue for some time to

come. Since mining is generally an expensive and extremely complex

undertaking, response to demand spikes is never instantaneous.

In order to ensure that their investments are adequately covered,

mining juniors tend to allow demand forces to push up prices up before making a

capital outlay on mining operations expansion. This results in cycles of supply

constriction followed by corrective investment that are referred to by industry

experts as supercycles.

Following this trend, and with the lithium industry poised to

grow by leaps and bounds, investors are betting heavily on the lithium demand

making miners and juniors in the space even more attractive.

Technical Disclosure: The preparation of this article was supervised by Mr.

William Feyerabend, a Certified Professional Geologist and a member of the

American Institute of Professional Geologists, and a Qualified Person as defined

under National Instrument 43-101. Mr. Feyerabend approves the scientific and

technical disclosure contained within this article.

POTENTIAL COMPARABLES

LSC Lithium Corp.

(TSX-V: LSC.V) (LSSCF)

LSC Lithium Corp. is an emerging lithium

producer that has amassed a large portfolio of prospective lithium salars in

Northern Argentina and is focused on becoming a significant player in the supply

of high quality lithium product to global markets. On August 16th, the company

announced that it will complete its previously announced private placement of

common shares at an offering price of $1.10 or $0.87 U.S. per common share. In

the aggregate, the offering is expected to consist of the issuance and sale of

up to 18,181,818 common shares for gross proceeds of up to $20-million. The

funds raised in the offering will allow LSC to further pursue the promising

exploration results to date by the implementation of an accelerated and expanded

exploration program for 2017.

Critical Elements

(TSX-V: CRE.V)

(OTCQX:CRECF)

Critical Elements Corporation, a junior mining company, acquires,

explores, and develops mining properties in Canada. It primarily explores for

copper, zinc, gold, silver, nickel, lead, lithium, niobium, tantalum, and

platinum group elements. Its flagship project is the Rose lithium-tantalum

property that consists of 500 claims covering a total area of 260.90 square

kilometers, located in the Eastmain greenstone belt. The company was formerly

known as First Gold Exploration Inc. and changed its name to Critical Elements

Corporation in February 2011. Critical Elements Corporation is headquartered in

Montreal, Canada.

Lithium Americas Corp.

(NYSE:LAC) (TSX:LAC.TO)

Lithium Americas recently announced the filing of a technical report (the

“Technical Report”) for the Thacker Pass lithium project (the “Thacker Pass

Project”), formerly Stage 1 of the Lithium Nevada project. The Thacker Pass

Project in Nevada, United States, is 100% owned by Lithium Nevada Corp., a

wholly-owned subsidiary of Lithium Americas. The Technical Report supports the

scientific and technical disclosure in the updated mineral resource estimates

contained in the Company's press release dated April 5, 2018. The Technical

Report entitled, "Independent Technical Report for the Thacker Pass Project in

Humboldt County, Nevada, USA" was prepared by “qualified persons” from Advisian

Americas, a division of the WorleyParsons Group, in compliance with National

Instrument 43-101 - Standards for Disclosure for Mineral Projects ("NI

43-101"). The Technical Report is available on SEDAR at www.sedar.com and on

the Company's website at www.lithiumamericas.com.

For a more in-depth look into NGZ you can view the in-depth

report at USA News Group:

http://usanewsgroup.com/2017/10/10/how-south-americas-lithium-triangle-is-gearing-up-to-feed-our-battery-addiction-1-3/

Article Source:

USA News Group

http://usanewsgroup.com

info@usanewsgroup.com

Legal Disclaimer/Disclosure:

This piece is an

advertorial and has been paid for. This document is not and should not be

construed as an offer to sell or the solicitation of an offer to purchase or

subscribe for any investment. No information in this Report should be construed

as individualized investment advice. A licensed financial advisor should be

consulted prior to making any investment decision. We make no guarantee,

representation or warranty and accept no responsibility or liability as to its

accuracy or completeness. Expressions of opinion are those of USA News Group

only and are subject to change without notice. USA News Group assumes no

warranty, liability or guarantee for the current relevance, correctness or

completeness of any information provided within this Report and will not be held

liable for the consequence of reliance upon any opinion or statement contained

herein or any omission. Furthermore, we assume no liability for any direct or

indirect loss or damage or, in particular, for lost profit, which you may incur

as a result of the use and existence of the information, provided within this

Report.

DISCLAIMER:

USA News Group is Source of all

content listed above. FN Media Group, LLC (FNM), is a third party publisher and

news dissemination service provider, which disseminates electronic information

through multiple online media channels. FNM is NOT affiliated in any manner

with USA News Group or any company mentioned herein. The commentary, views and

opinions expressed in this release by USA News Group are solely those

of USA News Group and are not shared by and do not reflect in any manner the

views or opinions of FNM. FNM is not liable for any investment decisions by its

readers or subscribers. FNM and its affiliated companies are a news

dissemination and financial marketing solutions provider and are NOT a

registered broker/dealer/analyst/adviser, holds no investment licenses and may

NOT sell, offer to sell or offer to buy any security. FNM was not compensated

by any public company mentioned herein to disseminate this press release but was

compensated forty five hundred dollars by a non-affiliated third party to

distribute this release on behalf of

NRG Metals Inc..

FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains "forward-looking statements" within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E the Securities Exchange Act of 1934, as amended and such forward-looking

statements are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. "Forward-looking statements" describe

future expectations, plans, results, or strategies and are generally preceded by

words such as "may", "future", "plan" or "planned", "will" or "should",

"expected," "anticipates", "draft", "eventually" or "projected". You are

cautioned that such statements are subject to a multitude of risks and

uncertainties that could cause future circumstances, events, or results to

differ materially from those projected in the forward-looking statements,

including the risks that actual results may differ materially from those

projected in the forward-looking statements as a result of various factors, and

other risks identified in a company's annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange Commission.

You should consider these factors in evaluating the forward-looking statements

included herein, and not place undue reliance on such statements. The

forward-looking statements in this release are made as of the date hereof and

FNM undertakes no obligation to update such statements.

Media Contact

Information:

FN Media Group,

LLC

Media Contact e-mail:

editor@financialnewsmedia.com

U.S. Phone: +1(954)345-0611

SOURCE USA News Group

Disclaimer

FN Media Group LLC (FNMG) owns and operates

FinancialNewsMedia.com (FNM)

which is a third party publisher that disseminates electronic information

through multiple online media channels. FNMG's intended purposes are to deliver

market updates and news alerts issued from private and publicly trading

companies as well as providing coverage and increased awareness for companies

that issue press to the public via online newswires. FNMG and its affiliated

companies are a news dissemination and financial marketing solutions provider

and are NOT a registered broker/dealer/analyst/adviser, holds no investment

licenses and may NOT sell, offer to sell or offer to buy any security. FNMG's

market updates, news alerts and corporate profiles are NOT a solicitation or

recommendation to buy, sell or hold securities. The material in this release is

intended to be strictly informational and is NEVER to be construed or

interpreted as research material. All readers are strongly urged to perform

research and due diligence on their own and consult a licensed financial

professional before considering any level of investing in stocks. The companies

that are discussed in this release may or may not have approved the statements

made in this release. Information in this release is derived from a variety of

sources that may or may not include the referenced company's publicly

disseminated information. The accuracy or completeness of the information is not

warranted and is only as reliable as the sources from which it was obtained.

While this information is believed to be reliable, such reliability cannot be

guaranteed. FNMG disclaims any and all liability as to the completeness or

accuracy of the information contained and any omissions of material fact in this

release. This release may contain technical inaccuracies or typographical

errors. It is strongly recommended that any purchase or sale decision be

discussed with a financial adviser, or a broker-dealer, or a member of any

financial regulatory bodies. Investment in the securities of the companies

discussed in this release is highly speculative and carries a high degree of

risk. FNMG is not liable for any investment decisions by its readers or

subscribers. Investors are cautioned that they may lose all or a portion of

their investment when investing in stocks. This release is not without bias, and

is considered a conflict of interest if compensation has been received by FNMG

for its dissemination. To comply with Section 17(b) of the Securities Act of

1933, FNMG shall always disclose any compensation it has received, or expects to

receive in the future, for the dissemination of the information found herein on

behalf of one or more of the companies mentioned in this release. For current

services performed FNMG has been compensated forty-nine hundred dollars for NRG

Metals Inc. coverage by

a non-affiliated third party. FNMG HOLDS NO SHARES OF NRG Metals Inc.

This release contains "forward-looking statements" within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E the Securities

Exchange Act of 1934, as amended and such forward-looking statements are made

pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words such as "may",

"future", "plan" or "planned", "will" or "should", "expected," "anticipates",

"draft", "eventually" or "projected". You are cautioned that such statements are

subject to a multitude of risks and uncertainties that could cause future

circumstances, events, or results to differ materially from those projected in

the forward-looking statements, including the risks that actual results may

differ materially from those projected in the forward-looking statements as a

result of various factors, and other risks identified in a company's annual

report on Form 10-K or 10-KSB and other filings made by such company with the

Securities and Exchange Commission. You should consider these factors in

evaluating the forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this release are

made as of the date hereof and FNMG undertakes no obligation to update such

statements.

|