| ||||||||||||||||||||||||

|

QMC Website | About | Properties | Investor Relations Get FinancialNewsMedia.com Alerts | ||||||||||||||||||||||||

Quantum Minerals Corp (OTC: QMCQF) (TSXV:QMX)

Breaking News

|

||||||||||||||||||||||||

| CrossCut ID | Li2O Grade (%) | Width (Feet) |

| No. 2 West | 1.24 | 4 |

| No. 1 West | 1.75 | 6 |

| Center | 1.32 | 6.9 |

| No. 1 East | 1.3 | 14.5 |

| No. 2 East | 1.8 | 12.3 |

| No. 3 East | 1.16 | 24.9 |

| No. 4 East | 2.3 | 7.3 |

These data from the 200-foot level of the Irgon Dike compare favorably not only

to the 2017 QMC surface channel samples released in the company’s news release

of March 05, 2018 but also to assayed historical 1953-1954 drill intersections

from various levels within the dike (QMC News Release of April 16, 2018) and

documented in the LCOC’s assessment report (Manitoba AR #94932).

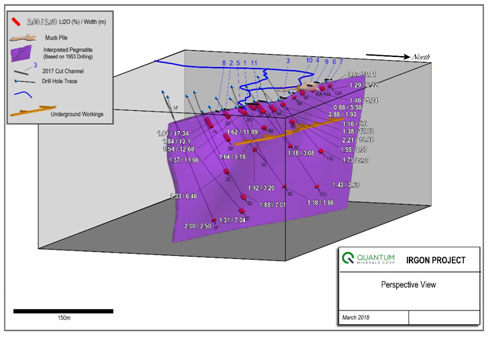

All historic data and recent surface geologic mapping are presented in the

3-dimensional model of the deposit which permits the viewer to easily visualize

the pegmatite, the underground workings and the 25 drill holes. This 3-D model

will be expanded as results from ongoing and future exploration programs on the

property are received by the company.

The 3-D model can be also viewed by following the link to the company’s website

(https://qmcminerals.com).

The upcoming drilling program is expected to confirm extensions to the strike

length of the Irgon Dike and test mineralization to depth below the current

level of historical drilling within the dike, both of which are expected to

rapidly increase the resource tonnage above the currently reported historical

tonnage of 1.2 million tons. Data received from the proposed drill program will

be used in preparation of a NI-43-101 report.

HISTORICAL RESOURCE

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes

into the Irgon Dike and subsequently reported a historical resource estimate of

1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a

depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This

historical resource is documented in a 1956 Assessment Report by B. B. Bannatyne

for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No.

94932). This historical estimate is believed to be based on reasonable

assumptions and neither the company nor the QP have any reason to contest the

document’s relevance and reliability. The detailed channel sampling and a

subsequent drill program will be required to update this historical resource to

current NI 43-101 standards. Historic metallurgical tests reported an 87%

recovery from which a concentrate averaging 5.9% Li2O was obtained.

During this historical 1950 era work program, a complete mining plant was

installed on site designed to process 500 tons of ore per day and a

three-compartment shaft was sunk to a depth of 74 meters. On the 61-metre level,

lateral development was extended off the shaft for a total of 366 meters of

drifting from which six crosscuts transected the dike. The work was suspended in

1957, awaiting a more favourable market for lithium oxides and at this time the

mine buildings were removed.

The mineral reserve cited above is presented as a historical estimate and uses

historical terminology which does not conform to current NI43-101 standards. A

qualified person has not done sufficient work to classify the historical

estimate as current mineral resources or mineral reserves. Although the

historical estimates are believed to be based on reasonable assumptions, they

were calculated prior to the implementation of National Instrument 43-101. These

historical estimates do not meet current standards as defined under sections 1.2

and 1.3 of NI 43-101; consequently, the issuer is not treating the historical

estimate as current mineral resources or mineral reserves.

Qualified Person and NI 43-101 Disclosure

The technical content of this news release has been reviewed and approved by

Bruce E. Goad, P. Geo. who is a qualified person as defined by National

Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition,

exploration and development of resource properties. Its objective is to locate

and develop economic precious, base, rare metal and resource properties of

merit. The Company’s properties include the Irgon Lithium Mine project and two

VMS properties, the Rocky Lake and Rocky-Namew, known collectively as the Namew

Lake District Project. Currently, all of the company’s properties are located in

Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this news release.

Source: QMC Quantum Minerals Corp.

QMC Reports Historic Li2O Assays From Drill Program on the Irgon Lithium Mine Property

Vancouver, British Columbia --April 16, 2018 -- Quantum Minerals Corp. (OTC:

QMCQF)

(TSX-V: QMC)

(FSE: 3LQ) (“QMC” or "the Company"). QMC is pleased to

disseminate the historical drilling results reported (Manitoba AR #94932) by the

Lithium Corporation of Canada (“LCOC”). These historical assays were obtained

during LCOC’s 1953/54 drilling program on the Irgon Dike. The Irgon Dike is

located at the company’s 100% owned Irgon Lithium Mine Project, within the

prolific Cat Lake-Winnipeg River Pegmatite Field of S.E. Manitoba, which also

hosts the nearby TANCO rare-element pegmatite.

LCOC collared 25 historic drill holes on the Irgon Dike. The drill hole

projections can be viewed in the 3-D model released by QMC on March 28, 2018,

which illustrates clearly that, to date, exploration and underground development

have been only undertaken on the upper and central portions of the dike, leaving

significant potential to quickly increase tonnage as the Irgon Dike is open both

along strike and to depth. The 2017 channel sample locations and surface

exposure of the dike are also indicated on the model.

These data from the historic drill intersections of the Irgon Dike compare

favourably to the 2017 QMC surface channel samples released in the company’s

news release of March 05, 2018. These results are documented in the LCOC’s

assessment report (Manitoba AR #94932) and these historical data are reproduced

below as Table 1.

Table 1: Historic Li2O Assay Results of LCOC’s Sampling of Pegmatite

Intersections Cut During Their 1953/54 Diamond Drill Program on the Irgon Dike.

DDH NO. Width

(m) True

Width

(m) Lithium Grade

(% Li2O) Notes DDH NO. Width

(m) True

Width

(m) Lithium Grade

(% Li2O) Notes

1A 17.3 12.2 1.01 6A 11.1 8.8 1.62

2A 12.1 10.1 1.84 Lost 0.6 feet of pegmatite core 7A 5.0 3.4 1.16

2B 12.0 9.1 1.37 8A 1.9 1.7 2.88

2C 6.4 5.0 1.33 8B 6.4 5.2 1.55

2D 2.5 2.1 2.00 8C 3.1 2.7 1.18

3A 12.7 11.6 1.54 Lost 0.7 feet of pegmatite core 8D 1.9 1.4 1.18

4A 10.9 9.5 2.21 Lost 0.4 feet of pegmatite core 9A 5.6 4.5 0.88 Lost 4.8 feet

of pegmatite core

5A 17.8 14.0 1.38 10A 5.2 4.3 1.46

5B 5.2 4.9 1.64 11A 6.2 4.9 1.29 Lost 0.8 feet of pegmatite core

5C 3.2 3.0 1.42 Visible spodumene over 1.4 feet not included in assay interval

11B 0.0 0.0 0.00 Missing core data

5D 7.0 5.5 1.85 11C 5.8 4.6 1.73

5E 0.0 0.0 0.00 Lost hole 11D 2.7 2.0 1.42

5F 7.0 6.4 1.31 12A 3.1 2.4 0.97

The 3-D model will be expanded as results from ongoing and future exploration

programs on the property are received by the Company. This 3-D model can be

viewed by following the link to the company’s website (https://qmcminerals.com).

The upcoming drilling program is expected to confirm extensions to the strike

length of the Irgon Dike and test mineralization to depth below the current

level of historical drilling within the dike; both of which are expected to

rapidly increase the resource tonnage above the currently reported historical

tonnage of 1.2 million tons. Data received from the proposed drill program will

be used in preparation of a NI-43-101 report.

HISTORICAL RESOURCE

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes

into the Irgon Dike and subsequently reported a historical resource estimate of

1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a

depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This

historical resource is documented in a 1956 Assessment Report by B. B. Bannatyne

for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No.

94932). This historical estimate is believed to be based on reasonable

assumptions and neither the company nor the QP have any reason to contest the

document’s relevance and reliability. The detailed channel sampling and a

subsequent drill program will be required to update this historical resource to

current NI 43-101 standards. Historic metallurgical tests reported an 87%

recovery from which a concentrate averaging 5.9% Li2O was obtained.

During this historical 1950-era work program, a complete mining plant was

installed onsite, designed to process 500 tons of ore per day; in addition, a

three-compartment shaft was sunk to a depth of 74 meters. On the 61-metre level,

lateral development was extended off the shaft for a total of 366 meters of

drifting, from which six crosscuts transected the dike. The work was suspended

in 1957, awaiting a more favourable market for lithium oxides and the mine

buildings were removed and the shaft sealed in 1963.

The mineral reserve cited above is presented as a historical estimate and uses

historical terminology, which does not conform to current NI43-101 standards. A

qualified person has not done sufficient work to classify the historical

estimate as current mineral resources or mineral reserves. Although the

historical estimates are believed to be based on reasonable assumptions, they

were calculated prior to the implementation of National Instrument 43-101. These

historical estimates do not meet current standards as defined under sections 1.2

and 1.3 of NI 43-101; consequently, the issuer is not treating the historical

estimate as current mineral resources or mineral reserves.

Qualified Person and NI 43-101 Disclosure

The technical content of this news release has been reviewed and approved by

Bruce E. Goad, P. Geo., who is a qualified person as defined by National

Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition,

exploration and development of resource properties. Its objective is to locate

and develop economic precious, base, rare metal and resource properties of

merit. The Company’s properties include the Irgon Lithium Mine project two VMS

properties, the Rocky Lake and Rocky-Namew known collectively as the Namew Lake

District Project. Currently, all of the company’s properties are located in

Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this news release.

Corporate Communications Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Source: QMC Quantum Minerals Corp.

Read Additional Special Reports for Quantum Minerals Corp (OTC: QMCQF) (TSXV:QMX)

https://www.networknewswire.com/soaring-demand-for-lithium-fuels-exploration-and-production-race/?utm_source=QuantumNativeAds&utm_medium=cpc&utm_campaign=QMC

https://www.networknewswire.com/qmc-quantum-minerals-corp-tsx-v-qmc-fse-3lq-otc-qmcqf-may-make-up-shortfall-in-hard-rock-lithium/?utm_source=QuantumNativeAds&utm_medium=cpc&utm_campaign=QMC

https://www.networknewswire.com/qmc-quantum-minerals-corp-tsx-v-qmc-fse-3lq-otc-qmcqf-3-d-model-suggests-larger-lithium-reserves/?utm_source=QuantumNativeAds&utm_medium=cpc&utm_campaign=QMC

Soaring Demand for Lithium

Fuels Exploration and Production Race

New York, NY – April 2018 – NetworkNewsWire News

Coverage: A January report from Zion Market Research projects the

global lithium-ion battery market, worth around $31 billion in 2016 and

dominated by Asia-Pacific producers such as China, is on track to grow at a CAGR

of 13.7 percent through 2022, ballooning to over $67.6 billion (http://nnw.fm/9gEz3).

Australia, Chile, Argentina and China are responsible for the lion’s share of

global lithium production (around 93 percent) — about half of which is currently

consumed by battery production. Prices per ton for the two main types of lithium

(hydroxide and carbonate) have jumped from around $6,500 in 2015 to recent highs

of more than $20,000. UBS Securities also recently projected that lithium demand

will continue to stay high through 2024 (http://nnw.fm/GCfv9), citing primary

drivers such as the burgeoning EV (electric vehicle) market, which is projected

to grow at a whopping 28.3 percent through 2026 (http://nnw.fm/T80kH). All of

this is extremely bullish news for lithium producers, whether we are talking

relatively small up-and-comers such as British Columbia-based

QMC Quantum Minerals Corp. (TSX-V: QMC) (FSE: 3LQ) (OTC: QMCQF) and

Nemaska Lithium, Inc. (TSX: NMX) (OTC: NMKEF), or sector heavyweights such as

Chile’s Sociedad Química y Minera de Chile S.A. (NYSE: SQM), Albemarle

Corporation (NYSE: ALB) and FMC Corporation (NYSE: FMC).

Australia, Chile, Argentina and China are responsible for the lion’s share of

global lithium production (around 93 percent) — about half of which is currently

consumed by battery production. Prices per ton for the two main types of lithium

(hydroxide and carbonate) have jumped from around $6,500 in 2015 to recent highs

of more than $20,000. UBS Securities also recently projected that lithium demand

will continue to stay high through 2024 (http://nnw.fm/GCfv9), citing primary

drivers such as the burgeoning EV (electric vehicle) market, which is projected

to grow at a whopping 28.3 percent through 2026 (http://nnw.fm/T80kH). All of

this is extremely bullish news for lithium producers, whether we are talking

relatively small up-and-comers such as British Columbia-based

QMC Quantum Minerals Corp. (TSX-V: QMC) (FSE: 3LQ) (OTC: QMCQF) and

Nemaska Lithium, Inc. (TSX: NMX) (OTC: NMKEF), or sector heavyweights such as

Chile’s Sociedad Química y Minera de Chile S.A. (NYSE: SQM), Albemarle

Corporation (NYSE: ALB) and FMC Corporation (NYSE: FMC).

Cleaner Cars Require Much More Lithium

Bloomberg New Energy Finance analysis of the EV market shows production will

increase more than thirtyfold by 2030 and relays Deutsche Bank estimates that

there are enough lithium reserves in the ground to last us another 185 years (http://nnw.fm/rm7qC). With developments on the horizon such as lithium-ion

batteries that could store a third more energy using a lithium metal electrode

instead of graphite, the race to develop lithium resources is officially on for

a world increasingly concerned about the cleanliness of the energy it consumes.

(http://nnw.fm/rm7qC). With developments on the horizon such as lithium-ion

batteries that could store a third more energy using a lithium metal electrode

instead of graphite, the race to develop lithium resources is officially on for

a world increasingly concerned about the cleanliness of the energy it consumes.

Recent flap from Morgan Stanley about a potential oversupply of lithium fails to

accurately account for both the insatiable demand and the rate of supply

throughput to end markets (http://nnw.fm/alG3C). SQM cited a 17 percent jump

last year in demand and estimated a 20 percent uptick this year in its annual

report. More importantly, not all lithium projects with a suitable grade are

necessarily economical, and an oversupply of mined product is not the same thing

as having an abundance of high-quality processed lithium that is ready to be

used in batteries. Producers that can systematically increase output are in a

prime position to make the most of this historic opportunity, especially as

increasingly cheap-to-produce batteries eat up more and more of the market,

eventually representing some 90 percent of all lithium consumption by the mid

2020s. That trend has put internal combustion engine vehicles on notice, with

estimates that by 2022 EVs will actually become cheaper than gas guzzlers

(http://nnw.fm/v8Ndw) and even outsell them by 2040 (http://nnw.fm/hfYA2).

Unprecedented Lithium Demand Drives Expansion

Underlying demand fundamentals are an important factor for

QMC Quantum Minerals Corp. (TSX-V: QMC) (FSE: 3LQ) (OTC: QMCQF) , which

recently expanded its 100 percent-owned Irgon Lithium Mine Project in Manitoba

by nearly fourfold to some 6,538 acres in the heart of this mining-friendly

province (http://nnw.fm/otSf2). Manitoba is currently well on its way to

becoming Canada’s most improved province and was ranked the second most

attractive global jurisdiction for mining investment in 2016 by Fraser Institute

(http://nnw.fm/qfQz4). The Irgon Lithium Mine Project site benefits from superb

access and the well-developed mining infrastructure that Manitoba has to offer.

Quantum Minerals subsequently followed up on its channel sampling program of

late last year (http://nnw.fm/yU7Gb) and the considerable acreage expansion at

Irgon with some impressive exploration finds. These finds included a number of

newly identified pegmatite dikes that kicked up some tantalizing trends via

initial field evaluation by onsite geological teams, including one trend running

approximately 410 feet along strike, with an exposed surface width ranging from

6.5 to 16.4 feet (http://nnw.fm/WHp6y; http://nnw.fm/M5H8w). Subsequent grab

sample assay results confirmed that the dikes, located south of the main Irgon

dike, do, indeed, bear considerable lithium mineralization, with one return

coming back at an impressive 2.6 percent Li2O (lithium oxide).

Quantum a Near-Term Producer with ‘Good Dirt’

Having been cleared by Manitoba’s Sustainable Development Office with a drill

permit in March, Quantum Minerals may be well-situated for its 2018 field

season. Plans are in the offing for a 6,561-foot drilling program designed to

validate the historic resource estimate from the 1950s, which showed 1.2 million

tons of Li2O at 1.51 percent over 1,198 feet to a depth of 700 feet. The 2018

field program will also test for extension(s) to the main dike below 700 feet.

Quantum Minerals will be bucking hard this year to update markets with a

thorough, NI 43-101-compliant resource estimate for the project, which

historically yielded an 87 percent recovery rate averaging 5.9 percent Li2O

concentrate during the historical 1950s-era work program. That same work program

also saw installation of a complete 500 tons per day mining plant and the

sinking of a 243-foot, three-compartment shaft, including 1,200 feet of lateral

extensions from which six crosscuts transected the main dike.

Full results of the late 2017 program that yielded 144 channel samples across

the width of the main dike comfortably exceed historic estimates. One interval

even showed 1.43 percent Li2O over 59 feet, including a sweet spot of 1.73

percent over 46 feet. Numerous grades from 3.05 to 4.31 percent Li2O over

3.28-foot intervals were also reported, and 41.1 percent of pegmatite assays

exhibited returned over 1 percent Li2O. There were also significant grades

identified of tantalum (310 ppm), niobium (275 ppm), rubidium (2,961 ppm),

cesium (567 ppm) and beryllium (325 ppm), further enhancing the Irgon project’s

overall economics.

Big Aces Up Quantum’s Sleeve

Previous lithogeochemical survey work at Irgon — looking for tantalum and tin

that was done on the dikes south of Cat Lake by Tantalum Mining Corporation of

Canada (“TANCO”) in the late 1970s — has given Quantum Minerals one particularly

choice data point to follow up on during the company’s 2018 field program. A

3,609-foot anomaly, which is 328 feet wide on the east end and nearly 1,150 feet

wide on the west end, was never assayed by TANCO for lithium due to a lack of

demand for the metal at that time, even though the exploration report indicated

it was a good idea to check it out (http://nnw.fm/Zu94n). This massive anomaly

could be a big win for QMC Quantum Minerals, adding considerable value to an

already impressive project, and the company looks eager to sink its teeth into

what may be a heavily mineralized region.

In addition to the extremely promising Irgon Lithium Mine Project, Quantum

Minerals has roughly 57,000 acres, known as the Namew Lake District property, up

in northwestern Manitoba’s world-class Flin Flon/Snow Lake VMS (volcanic massive

sulfide) district. A 43-101 report released in 2013 — after the company’s 2012

drilling program and VTEM (versatile time domain electromagnetic) survey, which

yielded 41 targets — recommended a work and exploration program to further

delineate the 100 percent-owned project’s properties as an economic mineral

resource. This project is proximal to Hudbay’s currently producing copper, zinc,

gold and silver bearing 777 Mine and is only 6.8 miles southwest of the Namew

Lake mine that previously produced 2.57 million tonnes of copper, nickel, gold,

silver, palladium and platinum. The Namew Lake District property has the

potential to host several distinct VMS bodies and represents a potential ace in

the hole for Quantum Minerals that investors should be aware of.

Proposed Tariffs Could Be a Boon for North American Producers

Recently proposed tariffs on lithium primary cells and batteries from China will

most likely not impact the EV supply chain (http://nnw.fm/gT5NM). However, this

turn of events will no doubt significantly boost the overall North American

lithium market, lighting a fire under companies throughout the industry.

Companies that either import or manufacture lithium-ion batteries, such as

Johnson Controls, Exide Technologies and A123Systems, will have to start

thinking about solutions closer to home. This is good news for North American

lithium producers, who already have trouble maintaining production rates that

keep up with skyrocketing demand.

And while Morgan Stanley recently cited massive Chilean production expansions as

potentially driving the price of lithium down 45 percent by 2021, the Trump

administration’s move toward protectionism could substantially change market

conditions, especially for companies such as Tesla, which uses 10,000 times more

lithium for one Model S than there is in the average smartphone battery and

which is currently in talks with Chile’s SQM to secure a steady supply of the

white metal. China alone has set massive goals for plug-in hybrids and EVs, with

quotas to this end coming online next year and plans to have such green vehicles

make up one-fifth of all the country’s auto sales by 2025.

Top Players Expanding Production Footprints

Nemaska Lithium, Inc. (TSX: NMX) (OTCQX: NMKEF) is a good example of a company

just north of the border with solid production capability on the table and plans

for increased production. A recent feasibility study for Nemaska’s

development-stage Whabouchi hard-rock lithium deposit in Quebec targets a 20

percent increase in capacity to 16,000 tonnes annually. The hybrid open-pit and

underground mine will have a 33-year mine life based on proven and probable

reserves of 24 million tonnes at 1.53 percent Li2O. Nemaska President and CEO

Guy Bourassa seemed extremely bullish during a January conference call, during

which he indicated the production expansion plans were a response to the

company’s understanding of both the underlying demand fundamentals and extensive

discussions with lithium-hungry customers around the globe (http://nnw.fm/b0e0V).

Sociedad Química y Minera de Chile S.A (NYSE: SQM), a fertilizer giant, a

veritable Chilean institution, and one of the world’s biggest producers of

lithium, recently announced a key agreement with the Chilean Economic

Development Agency (Corfo) (http://nnw.fm/UQth3). The agreement ends a yearslong

fight over SQM royalties and sets up the company, which is the lowest-cost

producer of lithium from Chile’s sprawling Salar de Atacama salt flat, to more

than double its lithium production by next year (http://nnw.fm/8Exb5). While SQM

has said it will gauge further production expansion based on prevailing market

conditions — likely due to the company’s share price drop after the Morgan

Stanley report — 100,000 tonnes is less than half of what the world consumed

annually two years ago. Furthermore, lithium demand is projected to grow

substantially well into the 2020s, and the company’s share price has rebounded

nicely since the Morgan Stanley selloff that impacted lithium producers earlier

this year, retracing to well above SQM’s 52-week median.

Albemarle Corporation (NYSE: ALB), a U.S.-based specialty chemicals company, is

the world’s other top producer of lithium, after the company’s acquisition of

Rockwood Holdings in 2014. The company amended its lithium production rights

agreement with Corfo last year to expand production in Chile to 80,000 metric

tons per year. Albemarle subsequently announced the development of a new

technology that will allow the company to increase that figure to 125,000 metric

tons per year without the need for additional brine pumping at the Salar de

Atacama, triggering a new demand to Corfo for an additional lithium quota

increase.

FMC Corporation (NYSE: FMC) is the third-largest lithium producer behind SQM and

ALB. The company announced earlier this year that it will expand production in

Argentina over the next few years to more than 40,000 metric tons via a $300

million investment — a deal that further illustrates the current land race

taking place among producers to lock in the best production sites around the

globe.

North and South America Are Development Hotspots

North American lithium production represents some of the lowest jurisdictional

risk to be found anywhere on earth and typically has well-developed

infrastructure and site access. Nevertheless, an increasingly insatiable global

demand for the so-called “white petroleum” has sent producers scrambling for

acreage in Chile, Argentina and Bolivia, where there is an abundance of salt

flat mineralization. Chile even recently announced plans to substantially revise

mining codes and make the country even more competitive as an investment target.

North or south, the story is the same: Smart producers can read the handwriting

on the wall as the trend is to shift away from hydrocarbons toward lithium and

other energy sources; these same producers are planting their flags on key

acreage and ramping up production volume.

For more information about Quantum Minerals, please visit

QMC Quantum Minerals Corp. (TSX-V: QMC) (FSE: 3LQ) (OTC: QMCQF)

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content distribution company that

provides (1) access to a network of wire services via NetworkWire to reach all

target markets, industries and demographics in the most effective manner

possible, (2) article and editorial syndication to 5,000+ news outlets (3),

enhanced press release services to ensure maximum impact, (4) social media

distribution via the Investor Brand Network (IBN) to nearly 2 million followers,

(5) a full array of corporate communications solutions, and (6) a total news

coverage solution with NNW Prime. As a multifaceted organization with an

extensive team of contributing journalists and writers, NNW is uniquely

positioned to best serve private and public companies that desire to reach a

wide audience of investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW brings its

clients unparalleled visibility, recognition and brand awareness. NNW is where

news, content and information converge. For more information, please visit

https://www.NetworkNewsWire.com.

Please see full terms of use and disclaimers on the NetworkNewsWire website

applicable to all content provided by NNW, wherever published or re-published:

http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article and content set

forth above. References to any issuer other than the profiled issuer are

intended solely to identify industry participants and do not constitute an

endorsement of any issuer and do not constitute a comparison to the profiled

issuer. FN Media Group (FNM) is a third-party publisher and news dissemination

service provider, which disseminates electronic information through multiple

online media channels. FNM is NOT affiliated with NNW or any company mentioned

herein. The commentary, views and opinions expressed in this release by NNW are

solely those of NNW and are not shared by and do not reflect in any manner the

views or opinions of FNM. Readers of this Article and content agree that they

cannot and will not seek to hold liable NNW and FNM for any investment decisions

by their readers or subscribers. NNW and FNM and their respective affiliated

companies are a news dissemination and financial marketing solutions provider

and are NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy any

security.

The Article and content related to the profiled company represent the personal

and subjective views of the Author, and are subject to change at any time

without notice. The information provided in the Article and the content has been

obtained from sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all such

information. None of the Author, NNW, FNM, or any of their respective

affiliates, guarantee the accuracy or completeness of any such information. This

Article and content are not, and should not be regarded as investment advice or

as a recommendation regarding any particular security or course of action;

readers are strongly urged to speak with their own investment advisor and review

all of the profiled issuer's filings made with the Securities and Exchange

Commission before making any investment decisions and should understand the

risks associated with an investment in the profiled issuer's securities,

including, but not limited to, the complete loss of your investment.

NNW & FNM HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains "forward-looking statements" within the meaning of Section

27A of the Securities Act of 1933, as amended, and Section 21E the Securities

Exchange Act of 1934, as amended and such forward-looking statements are made

pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. "Forward-looking statements" describe future expectations,

plans, results, or strategies and are generally preceded by words such as "may",

"future", "plan" or "planned", "will" or "should", "expected," "anticipates",

"draft", "eventually" or "projected". You are cautioned that such statements are

subject to a multitude of risks and uncertainties that could cause future

circumstances, events, or results to differ materially from those projected in

the forward-looking statements, including the risks that actual results may

differ materially from those projected in the forward-looking statements as a

result of various factors, and other risks identified in a company's annual

report on Form 10-K or 10-KSB and other filings made by such company with the

Securities and Exchange Commission. You should consider these factors in

evaluating the forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this release are

made as of the date hereof and NNW and FNM undertake no obligation to update

such statements.

NetworkNewsWire (NNW) is affiliated with the Investor Brand Network (IBN).

About IBN

Over the past 10+ years we have consistently introduced new network brands, each

specifically designed to fulfil the unique needs of our growing client base and

services. Today, we continue to expand our branded network of highly influential

properties, leveraging the knowledge and energy of specialized teams of experts

to serve our increasingly diversified list of clients.

Please feel free to visit the Investor Brand Network (IBN)

www.InvestorBrandNetwork.com

Corporate Communications Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Media Contact:

FN Media Group, LLC

NNW@FinancialNewsMedia.com

+1-(954)345-0611

News Source: NetworkNewsWire

QMC COMPLETES 3D MODELING FOR THE IRGON LITHIUM MINE

Vancouver, British Columbia --March 28, 2018 -- Quantum Minerals Corp. (OTC:

QMCQF)

(TSX-V: QMC)

(FSE: 3LQ) (“QMC” or "the Company"). QMC is pleased to report that North Face

Software Ltd. has completed compilation of all historical data derived from past

drilling and underground work and imported these data into an interactive

3-dimensional Leapfrog™ model of the Irgon Dike. The Irgon Dike is located at

the company’s 100% owned Irgon Lithium Mine Project, within the prolific Cat

Lake-Winnipeg River Pegmatite Field of S.E. Manitoba that hosts the nearby TANCO

rare-element pegmatite.

The 3-D model clearly demonstrates that to date, exploration and underground

development has been only undertaken on the central portion of dike leaving

significant potential to quickly increase tonnage as the Irgon Dike is open both

along strike and to depth. The 2017 channel sample locations and surface

exposure of the dike are also indicated on the model. Sampling results of these

surface channel cuts were listed in the company’s news release of March 05,

2018.

The upcoming drilling program will confirm extensions to the strike length of

the Irgon Dike and test mineralization to depth below the current level of

historical drilling within the dike; both which will rapidly increase the

resource tonnage above the currently reported historical tonnage of 1.2 million

tons. Data received from the proposed drill program will be used in preparation

of a NI-43-101 report.

All historic data and recent surface geologic mapping are presented in the

interactive 3-dimensional model of the deposit which permits the viewer to

easily visualize the pegmatite, the underground workings, the 25 drill holes and

to view the historic assay results of the mineralized drill intersections. This

interactive model will be expanded as results from ongoing and future

exploration programs on the property are received by the company.

The interactive model can be viewed by following the link to the company’s

website ( https://qmcminerals.com ). A

perspective model of the Irgon Dike looking towards the southwest is shown

below.

The company had contracted the services of North Face Software Ltd. and Inukshuk

Geological Consulting to compile, analyze and interpret the historical drill

data for the Irgon Mine as logged in 1953/54 by the Lithium Corporation of

Canada Ltd. (Manitoba Assessment Report #94932).

HISTORICAL RESOURCE

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes

into the Irgon Dike and subsequently reported a historical resource estimate of

1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a

depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This

historical resource is documented in a 1956 Assessment Report by B. B. Bannatyne

for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No. 94932). This historical estimate is believed to be based on reasonable

assumptions and neither the company nor the QP have any reason to contest the

document’s relevance and reliability. The ongoing detailed channel sampling and

a subsequent drill program will be required to update this historical resource

to current NI 43-101 standards. Historic metallurgical tests reported an 87%

recovery from which a concentrate averaging 5.9% Li2O was obtained.

94932). This historical estimate is believed to be based on reasonable

assumptions and neither the company nor the QP have any reason to contest the

document’s relevance and reliability. The ongoing detailed channel sampling and

a subsequent drill program will be required to update this historical resource

to current NI 43-101 standards. Historic metallurgical tests reported an 87%

recovery from which a concentrate averaging 5.9% Li2O was obtained.

During this historical 1950 era work program, a complete mining plant was

installed on site designed to process 500 tons of ore per day and in addition, a

three-compartment shaft was sunk to a depth of 74 meters. On the 61-metre level,

lateral development was extended off the shaft for a total of 366 meters of

drifting from which six crosscuts transected the dike. The work was suspended in

1957, awaiting a more favourable market for lithium oxides and at this time the

mine buildings were removed.

The mineral reserve cited above is presented as a historical estimate and uses

historical terminology which does not conform to current NI43-101 standards. A

qualified person has not done sufficient work to classify the historical

estimate as current mineral resources or mineral reserves. Although the

historical estimates are believed to be based on reasonable assumptions, they

were calculated prior to the implementation of National Instrument 43-101. These

historical estimates do not meet current standards as defined under sections 1.2

and 1.3 of NI 43-101; consequently, the issuer is not treating the historical

estimate as current mineral resources or mineral reserves.

Qualified Person and NI 43-101 Disclosure

The technical content of this news release has been reviewed and approved by

Bruce E. Goad, P. Geo. who is a qualified person as defined by National

Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition,

exploration and development of resource properties. Its objective is to locate

and develop economic precious, base, rare metal and resource properties of

merit. The Company’s properties include the Irgon Lithium Mine project two VMS

properties, the Rocky Lake and Rocky-Namew known collectively as the Namew Lake

District Project. Currently, all of the company’s properties are located in

Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this news release.

QMC Minerals Corp.

Tel: (604) 601-2018

email: info@qmcminerals.com

web: www.qmcminerals.com

Source: QMC Quantum Minerals Corp.

QMC Receives Drill Permit for the Irgon Lithium Mine Project

Vancouver, British Columbia --March 14, 2018 -- Quantum Minerals Corp. (OTC:

QMCQF)

(TSX-V: QMC)

(FSE: 3LQ) (“QMC” or "the Company"). QMC is pleased to report that it has

received a drill permit from the Sustainable Development Office (“SD”) of the

Manitoba Government for its proposed drill program on the Irgon Pegmatite Dike

at the company’s 100% owned Irgon Lithium Mine Project, S.E. Manitoba.

The Company is currently in the process of requesting and assessing bids from

drilling contractors prior to initiating a 2000 metre drill program designed to

confirm both the historic Li2O assays received from the 1953/54 drill program

and those obtained from historic sampling across the six crosscuts on the

200-foot level in the underground workings. These historic results are reported

in Manitoba Assessment Report #94932.

The Company also intends to drill test for extensions to the mineralized zone on

the Irgon Dike below the currently tested 213 metres (700 foot) depth. In

addition, it will evaluate potential lateral strike extensions both to the east

and to the west of the currently furthest known exposure of the outcropping

pegmatite dike.

Data received from this drill program in addition to the results of the recent

surface channel sampling program on the Irgon Dike (QMC News Release of March

05, 2018) will be compiled by QMC to update the non-NI43-101 compliant historic

resource of 1.2 million tons of 1.51% Li2O to current NI43-101 standards.

HISTORICAL RESOURCE

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes

into the Irgon Dike and subsequently reported a historical resource estimate of

1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a

depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This

historical resource is documented in a 1956 Assessment Report by B. B. Bannatyne

for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No.

94932). This historical estimate is believed to be based on reasonable

assumptions and neither the company nor the QP have any reason to contest the

document’s relevance and reliability. The ongoing detailed channel sampling and

a subsequent drill program will be required to update this historical resource

to current NI 43-101 standards. Historic metallurgical tests reported an 87%

recovery from which a concentrate averaging 5.9% Li2O was obtained.

During this historical 1950 era work program, a complete mining plant was

installed on site designed to process 500 tons of ore per day and in addition, a

three-compartment shaft was sunk to a depth of 74 meters. On the 61-metre level,

lateral development was extended off the shaft for a total of 366 meters of

drifting from which six crosscuts transected the dike. The work was suspended in

1957, awaiting a more favourable market for lithium oxides and at this time the

mine buildings were removed.

The mineral reserve cited above is presented as a historical estimate and uses

historical terminology which does not conform to current NI43-101 standards. A

qualified person has not done sufficient work to classify the historical

estimate as current mineral resources or mineral reserves. Although the

historical estimates are believed to be based on reasonable assumptions, they

were calculated prior to the implementation of National Instrument 43-101. These

historical estimates do not meet current standards as defined under sections 1.2

and 1.3 of NI 43-101; consequently, the issuer is not treating the historical

estimate as current mineral resources or mineral reserves.

Qualified Person and NI 43-101 Disclosure

The technical content of this news release has been reviewed and approved by

Bruce E. Goad, P. Geo. who is a qualified person as defined by National

Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition,

exploration and development of resource properties. Its objective is to locate

and develop economic precious, base, rare metal and resource properties of

merit. The Company’s properties include the Irgon Lithium Mine project two VMS

properties, the Rocky Lake and Rocky-Namew known collectively as the Namew Lake

District Project. Currently, all of the company’s properties are located in

Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this news release.

QMC Minerals Corp.

Tel: (604) 601-2018

email: info@qmcminerals.com

web: www.qmcminerals.com

Source: QMC Quantum Minerals Corp.

QMC Assays Exceed Historical Results

Vancouver, British Columbia --March 05, 2018 -- Quantum Minerals Corp. (OTC:

QMCQF)

(TSX-V: QMC)

(FSE: 3LQ) (“QMC” or "the Company"). QMC is pleased to report that the company

has received very positive assay results from the recent channel sampling

program undertaken on the Irgon Dike at the company’s 100% owned Irgon Lithium

Mine Project, S.E. Manitoba.

HIGHLIGHTS:

144 channel samples (over 139.1m) were obtained from 11 sawn channel cuts across

the width of the Irgon Dike (Figure 1).

- The best channel sample interval returned 1.43% Li2O over 18.0m - including

1.73% Li2O over 14.0m.

- Lithium grades of up to 4.31%, 4.0% and 3.05% Li2O over one metre intervals

were reported in the assay results. 22.2% of the pegmatite assays returned a

grade greater than 1.5% Li2O. 41.1% of the pegmatite assays returned a grade

greater than 1.0% Li2O.54.4% of the pegmatite assays returned a grade greater

than 0.5% Li2O.

- Tantalum (Ta), Niobium (Nb), Rubidium(Rb), Cesium (Cs) and Beryllium (Be)

grades of up to 319, 275, 2961, 567 and 325 ppm respectively were encountered

over one-meter sample intervals.

- The interval exhibiting the highest tantalum assay was from Cut 3: it returned

225ppm Ta over 5.6m.

- The interval exhibiting the highest cesium assay was from Cut 8: it returned

376ppm Cs over 4.7m.

- The interval exhibiting the highest niobium assay was from Cut 3: it returned

166ppm Nb over 4.0m.

- All samples were analyzed by SGS Labs in Lakefield, Ontario using a sodium

peroxide fusion and subsequent ICP-AES and - ICP MS scans for 56 elements

including Li, Ta, Nb, Cs, Rb and Be - all elements which may potentially be

found within the Winnipeg River area rare element-bearing pegmatites. Figure 1

below illustrates the outcrop trace of the Irgon Dike and the locations of the

sawn channel sample cuts.

Cuts 2, 5 and 8 (indicated by the * in the above table) were obtained at the

very eastern exposed extremity of the dike on surface. The dike here has begun

to finger into the host basaltic wall rock. At surface level, the width of the

dike is reduced as it appears to bifurcate; however, the pegmatite dike remains

host to significant spodumene (lithium) mineralization.

Cut 1, located approximately 71m west of Cut 8 (the easternmost sample site) was

taken across the widest exposed section of the dike, the best interval which

reported 14m at 1.73% Li2O.

Overall sampling on surface indicates the spodumene mineralization is uniform

both in abundance and crystal size. Spodumene mineralization is fairly

ubiquitous throughout the dike and its crystal length is generally around 3-5cm

which greatly reduces any inherent “nugget effect” that would occur with the

presence of much larger crystals that generally occur in pegmatites.

The company is also encouraged by the tantalum grades that have been received by

the surface sampling. Mineralization remains open in all directions.

Where rafts of host rock were encountered within the boundaries of the Irgon

Dike on the surface, the company separated the different lithologies but

included the mafic rafts as part of the calculated grade of the cut. These

basaltic rafts samples, although separated from the pegmatite samples, returned

anomalous values of Li2O to 0.77% and cesium to 567ppm.

QMC’s surface results confirm both the consistency and continuity of the

spodumene mineralization and the contained Li2O content within the dike at

surface. The current QMC results compare very favourably to the historic assays

reported by the 1956 Manitoba Assessment Report (AR94932) obtained from the

historical drilling and underground crosscut sampling.

HISTORICAL RESOURCE

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes

into the Irgon Dike and subsequently reported a historical resource estimate of

1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a

depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This

historical resource is documented in a 1956 Assessment Report by B. B. Bannatyne

for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No.

94932). This historical estimate is believed to be based on reasonable

assumptions and neither the company nor the QP have any reason to contest the

document’s relevance and reliability. The ongoing detailed channel sampling and

a subsequent drill program will be required to update this historical resource

to current NI 43-101 standards. Historic metallurgical tests reported an 87%

recovery from which a concentrate averaging 5.9% Li2O was obtained.

During this historical 1950 era work program, a complete mining plant was

installed on site designed to process 500 tons of ore per day and in addition, a

three-compartment shaft was sunk to a depth of 74 meters. On the 61-metre level,

lateral development was extended off the shaft for a total of 366 meters of

drifting from which six crosscuts transected the dike. The work was suspended in

1957, awaiting a more favourable market for lithium oxides and at this time the

mine buildings were removed.

The mineral reserve cited above is presented as a historical estimate and uses

historical terminology which does not conform to current NI43-101 standards. A

qualified person has not done sufficient work to classify the historical

estimate as current mineral resources or mineral reserves. Although the

historical estimates are believed to be based on reasonable assumptions, they

were calculated prior to the implementation of National Instrument 43-101. These

historical estimates do not meet current standards as defined under sections 1.2

and 1.3 of NI 43-101; consequently, the issuer is not treating the historical

estimate as current mineral resources or mineral reserves.

Qualified Person and NI 43-101 Disclosure

The technical content of this news release has been reviewed and approved by

Bruce E. Goad, P. Geo. who is a qualified person as defined by National

Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition,

exploration and development of resource properties. Its objective is to locate

and develop economic precious, base, rare metal and resource properties of

merit. The Company’s properties include the Irgon Lithium Mine project two VMS

properties, the Rocky Lake and Rocky-Namew known collectively as the Namew Lake

District Project. Currently, all of the company’s properties are located in

Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this news release.

Tel: (604) 601-2018

email: info@qmcminerals.com

web: www.qmcminerals.com

A summary of complete Li2O results and Figure 1 accompanying the press release

are available at: http://resource.globenewswire.com/Resource/Download/18886289-5883-4163-9a18-3a42237fe320

Source: QMC Quantum Minerals Corp.

QMC Identifies Huge Lithium Anomaly

Vancouver, British Columbia --March 01, 2018 -- Quantum Minerals Corp. (OTC:

QMCQF)

(TSX-V: QMC)

(FSE: 3LQ) (“QMC” or "the Company"). Following a thorough assessment of all

historical data available in the public record for the Irgon Property, QMC is

pleased to provide the following information on its 100% owned Irgon Lithium

Mine Project, S.E. Manitoba.

In 1978, the Tantalum Mining Corporation of Canada (“TANCO”) evaluated the

pegmatite dikes in the Cat Lake Area for potential sources of tantalum to be

utilized as feed for the TANCO mill which is located approximately 20km south of

the Irgon Property. During this program TANCO undertook a lithium

lithogeochemical survey over the area south of Cat Lake, between the Mapetre and

the Central Pegmatite Dikes. The stated purpose of this study was to delineate

potentially buried, or new tantalum-bearing pegmatite occurrences on the

property. A large, apparently relatively untested lithium anomaly was identified

in the TANCO assessment report (Manitoba AR92681). Figure 5 of this report

indicates that this lithium anomaly strikes generally east west and is

approximately 1100m long. The width of the irregular shaped anomaly is

approximately 100m at the east end, widening to approximately 350 metres at the

west end. The TANCO assessment report indicates that the “breath and length of

this feature is such that it cannot be accounted for by the known pegmatites in

the area”. It appears that although recommended to do so, this lithium anomaly

was never fully tested by TANCO; at that time TANCO had no interest in producing

lithium. TANCO did drill into the anomaly along the very western edge in the

area of the Central Dike (20 short DDH) and at the eastern end of the anomaly

into the Mapetre Dike (2 shor t

DDH) to test both these dikes for tantalum mineralization; however, the central

800 metre portion of this large lithium anomaly between the Central Dike and the

Mapetre Dike, appears to have remained untested. During the 1978 exploration

program, all pegmatite core recovered from this TANCO drilling collared both

along the western portion of this anomaly in the area of the Central Pegmatite

and along the eastern edge of the anomaly at the Mapetre Dike was assayed for

only tantalum (Ta) and tin (Sn); NO lithium assays were requested even with

spodumene mineralization noted in the drill logs.

t

DDH) to test both these dikes for tantalum mineralization; however, the central

800 metre portion of this large lithium anomaly between the Central Dike and the

Mapetre Dike, appears to have remained untested. During the 1978 exploration

program, all pegmatite core recovered from this TANCO drilling collared both

along the western portion of this anomaly in the area of the Central Pegmatite

and along the eastern edge of the anomaly at the Mapetre Dike was assayed for

only tantalum (Ta) and tin (Sn); NO lithium assays were requested even with

spodumene mineralization noted in the drill logs.

QMC will evaluate this entire area during 2018.

HISTORICAL RESOURCE

Between 1953-1954, the Lithium Corporation of Canada Limited drilled 25 holes

into the Irgon Dike and subsequently reported a historical resource estimate of

1.2 million tons grading 1.51% Li20 over a strike length of 365 meters and to a

depth of 213 meters (Northern Miner, Vol. 41, no.19, Aug. 4, 1955, p.3). This

historical resource is documented in a 1956 Assessment Report by B. B. Bannatyne

for the Lithium Corporation of Canada Ltd. (Manitoba Assessment Report No.

94932). This historical estimate is believed to be based on reasonable

assumptions and neither the company nor the QP have any reason to contest the

document’s relevance and reliability. The ongoing detailed channel sampling and

a subsequent drill program will be required to update this historical resource

to current NI 43-101 standards. Historic metallurgical tests reported an 87%

recovery from which a concentrate averaging 5.9% Li2O was obtained.

During this historical 1950 era work program, a complete mining plant was

installed on site designed to process 500 tons of ore per day and in addition, a

three-compartment shaft was sunk to a depth of 74 meters. On the 61-metre level,

lateral development was extended off the shaft for a total of 366 meters of

drifting from which six crosscuts transected the dike. The work was suspended in

1957, awaiting a more favourable market for lithium oxides and at this time the

mine buildings were removed.

The mineral reserve cited above is presented as a historical estimate and uses

historical terminology which does not conform to current NI43-101 standards. A

qualified person has not done sufficient work to classify the historical

estimate as current mineral resources or mineral reserves. Although the

historical estimates are believed to be based on reasonable assumptions, they

were calculated prior to the implementation of National Instrument 43-101. These

historical estimates do not meet current standards as defined under sections 1.2

and 1.3 of NI 43-101; consequently, the issuer is not treating the historical

estimate as current mineral resources or mineral reserves.

Qualified Person and NI 43-101 Disclosure

The technical content of this news release has been reviewed and approved by

Bruce E. Goad, P. Geo. who is a qualified person as defined by National

Instrument 43-101.

About the Company

QMC is a British Columbia based company engaged in the business of acquisition,

exploration and development of resource properties. Its objective is to locate

and develop economic precious, base, rare metal and resource properties of

merit. The Company’s properties include the Irgon Lithium Mine project two VMS

properties, the Rocky Lake and Rocky-Namew known collectively as the Namew Lake

District Project. Currently, all of the company’s properties are located in

Manitoba.

On behalf of the Board of Directors of

QMC QUANTUM MINERALS CORP.

“Balraj Mann”

Balraj Mann

President and Chief Executive Officer

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this news release.

Suite 600 - 666 Burrard Street, Vancouver, British Columbia V6C 2X3

Tel: (604) 601-2018 I email: info@qmcminerals.com I web: www.qmcminerals.com

Source: QMC Quantum Minerals Corp.

-------------------------------------------------------------------

About Quantum Minerals Corp:

Quantum Minerals Corp. is a junior mineral exploration company focused on the

acquisition, exploration and development of mineral properties. QMC holds

interests in certain mineral properties across Canada, with its Namew Lake

Volocanogenic Massise Sulphide (VMS) style prospects, comprising of the Rocky

Lake and Namew-Rockey projects, in Manitoba, Canada. The Carrot River

gold-silver project also in Manitoba. QMC recently added the Cat Lake lithium

project in Manitoba, which features a non-43-101 compliant historical resource

of 1-million tonnes of 1.5% Li²O discovered by the Lithium Corporation of Canada

in 1957.

QMC management’s extensive experience in the field of mineral exploration and

development give it a competitive advantage in discovering, appraising and

advancing mineral deposits. QMC also draws on the tremendous experience of its

management in the realm of corporate finance and public markets which will prove

invaluable in acquisition, financing, and creating overall shareholder value.

AN EXCITING NEW LITHIUM PROSPECT IN MANITOBA

WHY LITHIUM?

- POWERING THE FUTURE

The electric car revolution is still in its infancy - many more affordable,

electric vehicles are planned for release in the next few years

Elon Musk estimates that by 2018, Tesla alone may consume every ton of lithium

produced worldwide

- THE LITHIUM MARKET

A SURGE IN DEMAND

Since early 2015, lithium prices have more than tripled — shooting from $7,000 a

metric ton to upwards of $22,000

Goldman Sachs conservatively expects demand for lithium to triple by 2025

- IRGON LITHIUM MINE

1,203,500 TONS OF LITHIUM OXIDE

Historic rare-metal (Li-Cs-Nb-Ta) deposit within the Irgon pegmatite located

immediately north of Cat Lake, Manitoba

Substantial developmental work carried out by former owner – Lithium Corporation

of Canada

PROJECTS

- IRGON LITHIUM MINE PROJECT

The Irgon Lithium Mine Project contains a Rare-metal (Li-Ta-Cs) deposit within

the Irgon pegmatite located immediately north of Cat Lake Manitoba. Substantial

developmental work carried out by the former owner of the property – The Lithium

Corporation of Canada Limited. The Deposit contains an estimated resource of

more than 1.2M tonnes of spodumene-bearing pegmatite grading 1.5% Li2 O

The Irgon Lithium Mine property hosts several rare-element granitic pegmatite

occurrences, one of which hosts and is locally known as the former Irgon Mine.

The Irgon occurrence and several other known pegmatite dikes are situated on 4

adjoining mineral claims which comprise the Irgon Lithium Mine property. The

total area covered by the 13 claims is 2,647 hectares. Access to the property is

excellent as Provincial Highway 314 in southeast Manitoba transects the claims,

approximately 150km northeast of Winnipeg.

The property lies within the east-trending Mayville-Cat-Eculid Greenstone Belt

(“MCEGB”) located along the northern contact of the Maskwa Lake Batholith. This

northern greenstone belt has a similar structural geological setting as the Bird

River Greenstone Belt (“BRGB”) which is located along the southern contact of

the same batholith, and is parallel to and approximately18km to the south of the

MCEGB. The property is located 20km north of the Tanco Mine Property. The BRGB

hosts

the world-class Tanco rare element-bearing pegmatite dike. The Tanco Mine went

into production in 1969 and produced tantalum, cesium and lithium concentrate.

It was previously North America’s largest and sole producer of spodumene (Li),

tantalite (Ta) and pollucite (Cs).

hosts

the world-class Tanco rare element-bearing pegmatite dike. The Tanco Mine went

into production in 1969 and produced tantalum, cesium and lithium concentrate.

It was previously North America’s largest and sole producer of spodumene (Li),

tantalite (Ta) and pollucite (Cs).

The property covers the former Irgon Mine and several known pegmatite dikes of

which currently the largest and best exposed is the spodumene-bearing Irgon

Dike. This dike is well exposed on a glaciated surface and strikes N80°W with a

dip of 87°S. It currently has a total exposed strike length of 442 meters and

displays widths varying between 3 to 18 meters, with an average width of

approximately 7 meters. Near the centre of its widest section, the dike is

composed of large microcline crystals, from 39 to 61 centimeters along their

crystal faces, which lie in a finer-grained groundmass of quartz and spodumene.

The eastern portion of the deposit was sampled over a length of about 229 meters

(circa 1934) with samples sent for analyses at the Department of Mines, Ottawa.

The results, although considered by QMC to be historic, indicated contents of

40-53% spodumene for samples, and 7.44% Li20 contained within the spodumene

mineralization.

Between 1953-1954 the Lithium Corporation of Canada Limited drilled 25 holes

into the Irgon Dike and reported a historical resource estimate of 1.2 million

tons grading 1.51% Li20 over a strike length of 365 meters and to a depth of 213

meters. This historical resource is documented in a 1956 Assessment Report by

Bruce Ballantyne for the Lithium Corporation of Canada Ltd. (Manitoba Assessment

Report No. 94932). This historical estimate is believed to be based on

reasonable assumptions and the company/QP has no reason to contest the

document’s relevance and reliability. A detailed drill program will be required

to update this historical resource to current NI 43-101 standards. Historic

metallurgical tests reported an 87% recovery from which a concentrate averaging

5.9% Li2o was obtained. A complete mining plant was installed on site designed

to process 500 tons of ore per day and in addition, a three compartment shaft

sunk to a depth of 74 meters. On the 61 metre level, lateral development was

extended off the shaft for a total of 366 meters of drifting; from which six

crosscuts transected the dike. The work was suspended in 1957, awaiting a more

favourable market for lithium oxides and at this point the mine buildings were

removed.

QMC’s immediate objectives will be to complete a drilling program to update the

historical resource to NI43-101 standards, with the goal to ultimately determine

the economics of possible near term lithium production from the Irgon pegmatite

dike.

- NAMEW LAKE DISTRICT

- 100% owned, ~23,000 hectares (~57,000 acres) in one of the most productive

mining regions: between the Flin Flon/Snow Lake VMS mining district of Manitoba,

Canada

- Excellent year-round access and mining infrastructure in place: 14 kilometres

west of Highway 10, 15 kilometres west of the Hudson Bay Railway, and 5

kilometres south of the Namew Lake Road

- 43-101 Technical Report released May 2013 with recommendation of a work and

exploration program to define the Rocky Lake and Namew Lake properties as an

economic mineral resource

- Massive sulphide mineralization with visible chalcopyrite confirmed on the

main Rocky Lake target

- Massive sulphide mineralization confirmed on three VTEM targets from the

drilling program completed April 2012

- VTEM survey performed, identifying 41 targets

- Proximity to the currently producing 777 mine in the Flin Flon - Mining

District with a production rate of 1.49 million tonnes per year of copper, zinc,

gold and silver

- Potential host to several VMS bodies

Namew Lake District Property Description

The Namew Lake District property encompasses the Rocky Lake Discovery in the

world class, Flin Flon/Snow Lake VMS mining district in North Western Manitoba.

The property is 100% owned by QMC, covering approximately 23,000 hectares,

approximately 50 kilometres northwest of the town of The Pas and 65 kilometres

south of the mining centre and former smelter at Flin Flon off of Highway 10.

The Namew Lake property is also located 11 kilometres southwest of the Namew

Lake mine that had produced 2.57 million tonnes of copper, nickel, gold, silver,

palladium, and platinum.

WHY INVEST IN QMC?

QMC Quantum Minerals Corp. is focused on creating shareholder value through the

strategic acquisition and development of high quality Li-Ag-Au-Ni-Cu-Zn

prospects in Manitoba, Canada, one of the most productive mining regions with a

centralized and well-developed mining infrastructure and most mining friendly

places in the world.

QMC’s high-potential prospects in the world class Flin Flon VMS district, the

Cat Lake Lithium property (the former Irgon Mine) and an experienced management

team in both exploration geology and corporate finance put QMC in an excellent

position to take advantage of rising prices in Lithium, precious and base

metals.

QMC aims to execute comprehensive work programs on its Cat Lake (the former

Irgon Mine), Rocky Lake, Namew Lake, and Carrot River Projects to identify

economic mineral deposits for development and near term production.

SOURCE: http://qmcminerals.com/

Disclaimer

FN Media Group LLC (FNMG) owns and operates FinancialNewsMedia.com (FNM) which is a third party publisher that disseminates electronic information through multiple online media channels. FNMG's intended purposes are to deliver market updates and news alerts issued from private and publicly trading companies as well as providing coverage and increased awareness for companies that issue press to the public via online newswires. FNMG and its affiliated companies are a news dissemination and financial marketing solutions provider and are NOT a registered broker/dealer/analyst/adviser, holds no investment licenses and may NOT sell, offer to sell or offer to buy any security. FNMG's market updates, news alerts and corporate profiles are NOT a solicitation or recommendation to buy, sell or hold securities. The material in this release is intended to be strictly informational and is NEVER to be construed or interpreted as research material. All readers are strongly urged to perform research and due diligence on their own and consult a licensed financial professional before considering any level of investing in stocks. The companies that are discussed in this release may or may not have approved the statements made in this release. Information in this release is derived from a variety of sources that may or may not include the referenced company's publicly disseminated information. The accuracy or completeness of the information is not warranted and is only as reliable as the sources from which it was obtained. While this information is believed to be reliable, such reliability cannot be guaranteed. FNMG disclaims any and all liability as to the completeness or accuracy of the information contained and any omissions of material fact in this release. This release may contain technical inaccuracies or typographical errors. It is strongly recommended that any purchase or sale decision be discussed with a financial adviser, or a broker-dealer, or a member of any financial regulatory bodies. Investment in the securities of the companies discussed in this release is highly speculative and carries a high degree of risk. FNMG is not liable for any investment decisions by its readers or subscribers. Investors are cautioned that they may lose all or a portion of their investment when investing in stocks. This release is not without bias, and is considered a conflict of interest if compensation has been received by FNMG for its dissemination. To comply with Section 17(b) of the Securities Act of 1933, FNMG shall always disclose any compensation it has received, or expects to receive in the future, for the dissemination of the information found herein on behalf of one or more of the companies mentioned in this release. For current services performed FNMG has been compensated forty-four hundred dollars for Quantum Minerals Corp coverage by a non-affiliated third party. FNMG HOLDS NO SHARES OF Quantum Minerals CorpThis release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. "Forward-looking statements" describe future expectations, plans, results, or strategies and are generally preceded by words such as "may", "future", "plan" or "planned", "will" or "should", "expected," "anticipates", "draft", "eventually" or "projected". You are cautioned that such statements are subject to a multitude of risks and uncertainties that could cause future circumstances, events, or results to differ materially from those projected in the forward-looking statements, including the risks that actual results may differ materially from those projected in the forward-looking statements as a result of various factors, and other risks identified in a company's annual report on Form 10-K or 10-KSB and other filings made by such company with the Securities and Exchange Commission. You should consider these factors in evaluating the forward-looking statements included herein, and not place undue reliance on such statements. The forward-looking statements in this release are made as of the date hereof and FNMG undertakes no obligation to update such statements.