| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

LICO Energy Website | About | Projects | I.R. Get FinancialNewsMedia.com Alerts | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

LICO ENERGY METALS INC. (OTCQB: WCTXF) (TSX-V: LIC)

Breaking News

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

DDH |

From (m) |

To (m) |

Core length (m) |

Co (%) |

Ag (ppm) |

Cu (ppm) |

Zn (ppm) |

Pb (ppm) |

|

TE17-01 |

136.00 |

142.00 |

6.00 |

0.62 |

0.9 |

51 |

37 |

4 |

|

Incl. |

136.50 |

137.00 |

0.50 |

0.23 |

0.9 |

6 |

47 |

2 |

|

Incl. |

139.75 |

142.00 |

2.25 |

1.54 |

1.8 |

121 |

40 |

8 |

|

Incl. |

140.25 |

141.00 |

0.75 |

3.92 |

2.4 |

216 |

39 |

13 |

|

TE17-02 |

142.5 |

144.9 |

2.4 |

0.76 |

1.6 |

202 |

35 |

10 |

|

Incl. |

143 |

144.9 |

1.9 |

0.95 |

1.8 |

234 |

36 |

10 |

|

Incl. |

144.3 |

144.9 |

0.6 |

2.58 |

1.5 |

140 |

39 |

12 |

|

TE17-02 |

152 |

161 |

9 |

0.34 |

1.1 |

203 |

262 |

29 |

|

Incl. |

152 |

154.2 |

2.2 |

0.26 |

1 |

101 |

239 |

38 |

|

Incl. |

156 |

159.9 |

3.9 |

0.59 |

1.6 |

377 |

445 |

41 |

|

Incl. |

156 |

157.8 |

1.8 |

0.90 |

2.3 |

228 |

924 |

79 |

|

Incl. |

156.6 |

157.2 |

0.6 |

2.22 |

5.4 |

590 |

2705 |

226 |

|

TE17-03 |

128.5 |

129.5 |

1 |

0.11 |

3.1 |

183 |

28 |

26 |

|

TE17-03 |

152.4 |

155.7 |

3.3 |

0.09 |

1.2 |

13 |

22 |

5 |

|

TE17-03 |

155.1 |

155.7 |

0.6 |

0.22 |

1.7 |

23 |

14 |

8 |

|

TE17-04 |

138.00 |

144.00 |

6.00 |

1.82 |

4.7 |

742 |

49 |

20 |

Note: Intervals reported in Table 1 represent core lengths and not true widths.

Table 2: Drill hole Collar Information

|

DDH |

Azm |

Dip |

|

TE17-01 |

090 |

-49 |

|

TE17-02 |

090 |

-45 |

|

TE17-03 |

090 |

-45 |

|

TE17-04 |

090 |

-45 |

|

TE17-05 |

090 |

-45 |

|

TE17-06 |

090 |

-45 |

|

TE17-07 |

090 |

-50 |

QA/QC Program

LiCo Energy Metals Inc. has implemented a quality assurance/quality control

(QA/QC) program for both the Glencore Bucke and Teledyne Property drill

programs.

Diamond drill core was logged, then sawed in half, with one half placed in a

labelled bag, and the remaining half placed back into the core box and stored in

a secured compound. Either a standard or a blank was inserted every 20th sample.

All samples were shipped to Activation Laboratories in Ancaster, Ontario. Each

sample is coarsely crushed and a 250 g aliquot is pulverized for analysis. A

0.25g sample is digested with a near total digestion (4 acids) and then analyzed

using an ICP. QC for the digestion is 14% for each batch, 5 method reagent

blanks, 10 in-house controls, 10 samples duplicates, and 8 certified reference

materials. An additional 13% QC is performed as part of the instrumental

analysis to ensure quality in the areas of instrumental drift. If over limits

for Cu, Pb, Zn, and Co are encountered, a sodium peroxide fusion, acid

dissolution followed by ICP‐OES is completed. For Ag over limits, a four acid

digestion is completed followed by ICP‐OES.

Qualified Person

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

About LiCo Energy Metals: https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary

listing is on the TSX Venture Exchange. The Company's focus is directed towards

exploration for high value metals integral to the manufacture of lithium ion

batteries.

Glencore Bucke Cobalt Project (Cobalt, Ontario): The Company has purchased a

100% interest from Glencore Canada Corporation (subsidiary of Glencore plc) in

the Glencore Bucke Property, situated in Bucke Township, 6 km east-northeast of

Cobalt, Ontario, subject to a back-in provision, production royalty and off-take

agreement. Strategically, the Glencore Bucke Property consists of 16.2 hectares

and sits along the west boundary of LiCo’s Teledyne Cobalt Project. The Property

covers the southern extension of the #3 vein that was historically mined on the

neighbouring Cobalt Contact Property located to the north of the Glencore Bucke

Property. Diamond drilling in 1981 on the Glencore Bucke Property delineated two

zones of mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project (Cobalt, Ontario):

The Company has an option to earn 100% ownership, subject to a royalty, in the

Teledyne Project located near Cobalt. Ontario. The Property adjoins the south

and west boundaries of claims that hosted the Agaunico Mine. From 1905 through

to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and

980,000 oz. of silver. A significant portion of the cobalt that was produced at

the Agaunico Mine located along structures that extended southward onto the

Teledyne property. The Company completed a total of 11 diamond drill holes

totaling 2,200 m in the fall of 2017. The drilling has confirmed cobalt

mineralization present on the Property which is consistent with historical

grades as reported historically by Cunningham-Dunlop (1979) and Bressee (1981),

disclosed in earlier news releases. These reports are available in the public

domain through MNDM’s AFRI database.

NI 43-101 Reports for both the Teledyne and Glencore Bucke Properties, are

publicly available on www.SEDAR.com as well as the Company’s website. LiCo’s

recently completed diamond drilling program (September to December 2017)

consisted of both twinning and infill drilling of the historical drill holes

located on both the Teledyne Cobalt and Glencore Bucke Properties.

Purickuta Lithium Project (Chile):

The Purickuta Project is located within Salar de Atacama, a salt flat

encompassing 3,000 km2, being about 100 km long, 80 km wide and home to

approximately 37% of the worlds Lithium production and Chile itself holds 53% of

the world’s known lithium reserves (Source: Bloomberg Markets – June 23, 2017,

“Lithium Squeeze Looms as Top Miner Front-Loads, Chile Says”). The property is

160 hectares large and is enveloped by a concession owned by Sociedad Quimica y

Minera (“SQM”) and lies within a few kilometers of a property owned by CORFO

(the Chilean Economic Development Agency) where its leases land to both SQM and

Albermarle’s Rockwood Lithium Corp. (“Albermarle”) for lithium extraction.

Together these two companies, SQM and Albermarle, have a combined annual

production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) making up

100% of Chile’s current lithium

output. As reported in The Economist (June 15, 2017 – A battle for supremacy in

the lithium triangle), the Salar de Atacama has the largest and highest quality

proven reserves of lithium. The combination of the desert’s hot sun, scarce

rainfall, and the mineral-rich brines make Chile’s production costs the world’s

lowest. This together with a favourable investment climate, low levels of

corruption, and the quality of its bureaucracy and courts makes Chile a

favourable place to conduct business.

Dixie Valley Lithium Project (Nevada, USA):

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a

large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley,

Nevada. Some important geological similarities exist between various lithium

brines, notably geothermal activity, a dry climate, a closed basin, an aquifer,

and tectonically driven subsistence exist at Dixie Valley along with Clayton

Valley and various lithium bearing salars in Chile, Argentina and Bolivia.

Black Rock Desert Lithium Project (Nevada, USA):

The Company has entered into an option agreement whereby the Company may earn an

undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium

Project in southwest Black Rock Desert, Washoe County, Nevada.

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are

not limited to, comments that involve future events and conditions, which are

subject to various risks and uncertainties. Except for statements of historical

facts, comments that address resource potential, upcoming work programs,

geological interpretations, receipt and security of mineral property titles,

availability of funds, and others are forward-looking. Forward-looking

statements are not guarantees of future performance and actual results may vary

materially from those statements. General business conditions are factors that

could cause actual results to vary materially from forward-looking statements.

Contact:

Phone: +1(236)521-0207

LiCoEnergyMetals.com

SOURCE LiCo Energy Metals Inc

LiCo Energy Metals - Intersects 0.77 % Cobalt over 3.40 m and 1.50% over 0.40 m at the Teledyne Cobalt Property

Vancouver, British Columbia --March 7, 2018 -- LiCo Energy Metals

Inc. (OTCQB: WCTXF)

(TSX-V: LIC)

("the Company" or "LiCo") is pleased to report assay results for

drill holes TE17-06 through to TE17-11 completed on the Teledyne Cobalt

Property, located 6 km northeast of Cobalt, Ontario. The current drill program

was designed to confirm and extend the existing known mineralization along

strike and up and down dip.

“LiCo is pleased to report the final assay results for the Phase 1 diamond drill

program completed at the Teledyne Cobalt Property. Drill hole TE17-08

intersected multiple zones of cobalt mineralization over a core interval of just

over 19 m” says Tim Fernback, President & CEO of LiCo.

Tim Fernback, President & CEO of LiCo.

A summary of the most significant results of the recent drill core assays are:

• TE17-07 0.50% Co over 2.10 m from 127.60 to 129.70 m, including 1.50% over

0.40 cm from

128.20 to 128.60 m.

• TE17-08 0.77% Co over 3.40 m from 169.50 to 172.90 m, including 1.17% Co over

2.00 m from

169.50 to 171.50 m.

• TE17-08 0.59% Co over 1.20 m from 174.00 to 175.20 m.

• TE17-08 0.62% Co over 0.60 m from 178.60 to 179.20 m.

• TE17-11 0.54% Co over 2.00 m from 130.00 to 132.00 m, including 1.07% Co over

0.50 m from

130.00 to 130.50 m.

On the Teledyne Cobalt Property, the Company completed a total of 11 diamond

drill holes totaling 2,200 m in the fall of 2017.

The results and drill hole collar information for diamond drill holes TE17-06 to

TE17-11 are summarized in Tables 1 & 2 below.

Table 1: Summary of Diamond Drill Results

|

DDH |

From (m) |

To (m) |

Core Length (m) |

Co (%) |

Ag (ppm) |

Cu (ppm) |

Zn (ppm) |

Pb (ppm) |

|

TE17-06 |

164.00 |

165.00 |

1.00 |

0.14 |

0.7 |

4 |

33 |

6 |

|

TE17-07 |

127.60 |

129.70 |

2.10 |

0.50 |

2.3 |

130 |

157 |

32 |

|

|

128.20 |

128.60 |

0.40 |

1.50 |

6.6 |

206 |

84 |

46 |

|

TE17-08 |

160.00 |

160.50 |

0.50 |

0.25 |

7.7 |

516 |

27 |

402 |

|

TE17-08 |

165.50 |

166.50 |

1.00 |

0.23 |

4.7 |

59 |

31 |

652 |

|

TE17-08 |

169.50 |

172.90 |

3.40 |

0.77 |

7.6 |

252 |

68 |

1370 |

|

incl. |

169.50 |

171.50 |

2.00 |

1.17 |

8.3 |

62 |

41 |

1758 |

|

incl. |

171.00 |

171.50 |

0.50 |

2.09 |

23.5 |

228 |

46 |

5400 |

|

TE17-08 |

174.00 |

175.20 |

1.20 |

0.59 |

21 |

338 |

43 |

2191 |

|

incl. |

174.30 |

175.20 |

0.90 |

0.71 |

24.4 |

437 |

43 |

2548 |

|

TE17-08 |

178.60 |

179.20 |

0.60 |

0.62 |

20.8 |

101 |

72 |

991 |

|

TE17-09 |

145.50 |

147.50 |

2.00 |

0.09 |

0.4 |

13 |

16 |

5 |

|

incl. |

146.40 |

146.65 |

0.25 |

0.20 |

0.4 |

5 |

15 |

2 |

|

TE17-10 |

124.55 |

128.00 |

3.45 |

0.11 |

0.5 |

10 |

24 |

4 |

|

incl. |

124.55 |

125.50 |

0.95 |

0.19 |

0.7 |

9 |

25 |

5 |

|

TE17-11 |

130.00 |

132.00 |

2.00 |

0.54 |

1.1 |

13 |

36 |

8 |

|

incl. |

130.00 |

130.50 |

0.50 |

1.07 |

0.7 |

14 |

29 |

3 |

Note: Intervals reported in Table 1 represent core lengths and not true widths

Table 2: Drill hole Collar Information

|

DDH |

Azm |

Dip |

|

TE17-06 |

090 |

-45 |

|

TE17-07 |

090 |

-50 |

|

TE17-08 |

090 |

-49 |

|

TE17-09 |

090 |

-45 |

|

TE17-10 |

090 |

-45 |

|

TE17-11 |

090 |

-54 |

QA/QC Program

LiCo Energy Metals Inc. has implemented a quality assurance/quality control (QA/QC) program for Teledyne Cobalt Property Phase 1 diamond drilling program.

Diamond drill

core was logged, then sawed in half, with one half placed in a labelled bag, and

the remaining half placed back into the core box and stored in a secured

compound. Either a standard or a blank was inserted every 20th sample. All

samples were shipped to Activation Laboratories in Ancaster, Ontario. Each

sample is coarsely crushed and a 250 g aliquot is pulverized for analysis. A

0.25g sample is digested with a near total digestion (4 acids) and then analyzed

using an ICP. QC for the digestion is 14% for each batch, 5 method reagent

blanks, 10 in-house controls, 10 samples duplicates, and 8 certified reference

materials. An additional 13% QC is performed as part of the instrumental

analysis to ensure quality in the areas of instrumental drift. If over limits

for Cu, Pb, Zn, and Co are encountered, a sodium peroxide fusion, acid

dissolution followed by ICP-OES is completed. For Ag over limits, a four-acid

digestion is completed followed by ICP-OES.

Qualified Person

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

About LiCo Energy Metals:

https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary

listing is on the TSX Venture Exchange. The Company's focus is directed towards

exploration for high value metals integral to the manufacture of lithium ion

batteries.

Glencore Bucke Cobalt Project (Cobalt, Ontario): The Company has purchased a

100% interest from Glencore Canada Corporation (subsidiary of Glencore plc) in

the Glencore Bucke Property, situated in Bucke Township, 6 km east-northeast of

Cobalt, Ontario, subject to a back-in provision, production royalty and off-take

agreement. Strategically, the Glencore Bucke Property consists of 16.2 hectares

and sits along the west boundary of LiCo’s Teledyne Cobalt Project. The Property

covers the southern extension of the #3 vein that was historically mined on the

neighbouring Cobalt Contact Property located to the north of the Glencore Bucke

Property. Diamond drilling in 1981 on the Glencore Bucke Property delineated two

zones of mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project (Cobalt, Ontario):

The Company has an option to earn 100% ownership, subject to a royalty, in the

Teledyne Project located near Cobalt. Ontario. The Property adjoins the south

and west boundaries of claims that hosted the Agaunico Mine. From 1905 through

to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and

980,000 oz. of silver. A significant portion of the cobalt that was produced at

the Agaunico Mine located along structures that extended southward onto the

Teledyne property. The Company completed a total of 11 diamond drill holes

totaling 2,200 m in the fall of 2017. The drilling has confirmed cobalt

mineralization present on the Property which is consistent with historical

grades as reported historically by Cunningham-Dunlop (1979) and Bressee (1981),

disclosed in earlier news releases. These reports are available in the public

domain through MNDM’s AFRI database.

NI 43-101 Reports for both the Teledyne and Glencore Bucke Properties, are

publicly available on www.SEDAR.com as well as the Company’s website. LiCo’s

recently completed diamond drilling program (September to December 2017)

consisted of both twinning and infill drilling of the historical drill holes

located on both the Teledyne Cobalt and Glencore Bucke Properties.

Purickuta Lithium Project (Chile):

The Purickuta Project is located within Salar de Atacama, a salt flat

encompassing 3,000 km2, being about 100 km long, 80 km wide and home to

approximately 37% of the worlds Lithium production and Chile itself holds 53% of

the world’s known lithium reserves (Source: Bloomberg Markets – June 23, 2017,

“Lithium Squeeze Looms as Top Miner Front-Loads, Chile Says”). The property is

160 hectares large and is enveloped by a concession owned by Sociedad Quimica y

Minera (“SQM”) and lies within a few kilometers of a property owned by CORFO

(the Chilean Economic Development Agency) where its leases land to both SQM and

Albermarle’s Rockwood Lithium Corp. (“Albermarle”) for lithium extraction.

Together these two companies, SQM and Albermarle, have a combined annual

production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) making up

100% of Chile’s current lithium output. As reported in The Economist (June 15,

2017 – A battle for supremacy in the lithium triangle), the Salar de Atacama has

the largest and highest quality proven reserves of lithium. The combination of

the desert’s hot sun, scarce rainfall, and the mineral-rich brines make Chile’s

production costs the world’s lowest. This together with a favourable investment

climate, low levels of corruption, and the quality of its bureaucracy and courts

makes Chile a favourable place to conduct business.

Dixie Valley Lithium Project (Nevada, USA):

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a

large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley,

Nevada. Some important geological similarities exist between various lithium

brines, notably geothermal activity, a dry climate, a closed basin, an aquifer,

and tectonically driven subsistence exist at Dixie Valley along with Clayton

Valley and various lithium bearing salars in Chile, Argentina and Bolivia.

Black Rock Desert Lithium Project (Nevada, USA):

The Company has entered into an option agreement whereby the Company may earn an

undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium

Project in southwest Black Rock Desert, Washoe County, Nevada.

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are

not limited to, comments that involve future events and conditions, which are

subject to various risks and uncertainties. Except for statements of historical

facts, comments that address resource potential, upcoming work programs,

geological interpretations, receipt and security of mineral property titles,

availability of funds, and others are forward-looking. Forward-looking

statements are not guarantees of future performance and actual results may vary

materially from those statements. General business conditions are factors that

could cause actual results to vary materially from forward-looking statements.

Contact:

Phone: +1(236)521-0207

LiCoEnergyMetals.com

SOURCE LiCo Energy Metals Inc.

LiCo Energy Metals - Completes its Final Payment to Glencore Canada Corporation and Finalizes the Purchase of 100% for the Mineral Rights on the Glencore Bucke Property

Vancouver, British Columbia --March 5, 2018 -- LiCo Energy Metals

Inc. (OTCQB: WCTXF)

(TSX-V: LIC)

("the Company" or "LiCo") is pleased to announce that it has

formally completed its obligations to Glencore Canada Corporation under the

Mineral Property Acquisition Agreement ("Property Agreement") dated August 31st

2017 and announced on September 5, 2017 by the Company. The Mineral Rights were

owned originally by Glencore ppCanada Corporation (subsidiary of Glencore plc)

("Glencore") of Baar Switzerland (LSE: GLEN). The Property Agreement allows LiCo

to acquire a 100% interest in mining rights for patent #585 (the "Glencore Bucke

property") situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario.

The Purchase Agreement includes a back-in provision, production royalty and an

off-take agreement in favor of Glencore.

Glencore is one of the world's largest producers of cobalt as a result of

by-products created from its copper assets in the DRC and nickel assets in

Australia, Canada and Norway.

"We are very excited to formally acquire this strategically located cobalt

property from Glencore. Its purchase agreement allows LiCo to expand upon one of

Glencore's longstanding Canadian cobalt assets. If all goes as planned, we could

be selling all our cobalt produced back to Glencore in the future. As I have

mentioned before, not only is this a great cobalt asset, but we have also found

a significant future customer in Glencore," states Tim Fernback, LiCo's

President & CEO.

Strategically, the Glencore Bucke property consists of 16.2 hectares and sits

along the west boundary of LiCo's Teledyne Cobalt Project that covers the

southern extension of the former producing 15 Vein on the past-producing

Agaunico Mine Property. Historically, the Agaunico Mine produced 4,350,000 lbs.

of cobalt and 980,000 oz. of silver during the mining boom of the early 1900's

(Cunningham-Dunlop, 1979).

In the early 80's the Glencore Bucke property was explored by 36 surface diamond

drill holes totaling 3,323 m. The drilling program outlined two separate vein

systems hosting significant cobalt and silver values. The two zones are known as

the Main Zone, measuring 152.4 m in length, and the Northwest Zone, measuring

70.0 m in length. The Main Zone had a north-south strike, which is hypothesized

as the southern extension of the #3 vein from the Cobalt Contact Mine located

immediately to the north of lease #585 (Bresee, 1982). Additional work was

recommended but never completed due to a downturn in cobalt prices at the time.

LiCo has recently completed the Glencore Bucke Property Phase 1 diamond drilling

program. During the fall of 2017, LiCo completed 21 diamond drill holes totaling

1,900 m. A summary of the results of the Glencore Bucke Property Phase 1 diamond

drilling program can be found in LiCo's news release dated January 26, 2018.

On LiCo's adjacent Teledyne property, historical drilling also encountered two

zones of cobalt/silver mineralization extending from the boundary of mined zones

at the Agaunico Mine in a north-south direction. In 1980, Teledyne completed a

700 m long production decline to reach the mineralization encountered in their

surface drill program. Both the surface and underground drilling programs

confirmed the extension of the Agaunico cobalt zones onto the Teledyne property

for a strike length of 152.4 m. In addition, the drill program encountered a

second zone with a strike length of 137.2 m. The most significant results

included 0.644% Co over 16.9 m, 0.74% Co over 8.7m, and 2.59% Co over 2.4 m (Bresee,

1981). LiCo has recently completed a Phase 1 diamond drilling program on the

Teledyne Property in the fall of 2017, whereby LiCo completed 11 diamond drill

holes totaling 2,200 m.

Terms of the Acquisition

Purchase Price - The Purchaser shall pay to the Vendor the sum of $150,000 on

the Approval Date; and pay to the Vendor the sum of $350,000 within 6 months

after the date of the Agreement (the "Closing Date"). In addition, prior to the

Closing Date during the Acquisition Period, the Purchaser shall incur $250,000

in Exploration Expenditures on the Property.

Offtake Agreement - Prior to the commencement of Commercial Production, the

Purchaser shall enter into an off-take agreement with the Vendor for all ores

and/or concentrates produced from the Property and/or the Teledyne Property. The

off-take agreement shall be on such terms and conditions as are commercially

reasonable and at prevailing market prices;

Production Royalty - The Royalty will consist of a 3.5% of Net Smelter Return

calculated on a quarterly basis on all Products extracted from, processed and

sold that originate from mining operations on the Property from and after

Commercial Production. One-half (1/2) of the Royalty can be purchased for

$1,000,000 payable to the Vendor or its assignee;

Back-In Option - from and after the Closing Date, subject to Glencore or an

affiliate, determining that a discovery of one or more ore bodies having a

minimum aggregate in-situ value of $100M or more from which minerals can be

feasibly extracted, the Purchaser grants to the Vendor or its nominated

affiliate an irrevocable, sole and exclusive right and option to acquire from

the Purchaser a 51% interest in the Property and all Property Rights, free and

clear of all burdens of any nature or kind. Once the Back-in Option is exercised

a joint venture will be formed and a management committee established with

representatives of both companies.

About Glencore:

Glencore plc is a leading integrated commodity producer and trader, operating

worldwide with diversified operations comprising around 150 mining and

metallurgical, oil production and agricultural assets. Glencore's industrial and

marketing activities are supported by a global network of more than 90 offices

located in over 50 countries where they employ around 155,000 people, including

contractors. Glencore trades in and distribute physical commodities sourced from

third party producers as well as their own production. The company also provide

financing, processing, storage, logistics and other services to commodity

producers and consumers.

About LiCo Energy Metals:

https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary

listing is on the TSX Venture Exchange. The Company's focus is directed towards

exploration for high value metals integral to the manufacture of lithium ion

batteries.

Glencore Bucke Cobalt Project (Cobalt, Ontario): The Company has purchased a

100% interest from Glencore Canada Corporation (subsidiary of Glencore plc) in

the Glencore Bucke Property, situated in Bucke Township, 6 km east-northeast of

Cobalt, Ontario, subject to a back-in provision, production royalty and off-take

agreement. Strategically, the Glencore Bucke Property consists of 16.2 hectares

and sits along the west boundary of LiCo's Teledyne Cobalt Project. The Property

covers the southern extension of the #3 vein that was historically mined on the

neighbouring Cobalt Contact Property located to the north of the Glencore Bucke

Property. Diamond drilling in 1981 on the Glencore Bucke Property delineated two

zones of mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project (Cobalt, Ontario):

The Company has an option to earn 100% ownership, subject to a royalty, in the

Teledyne Project located near Cobalt. Ontario. The Property adjoins the south

and west boundaries of claims that hosted the Agaunico Mine. From 1905 through

to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and

980,000 oz. of silver. A significant portion of the cobalt that was produced at

the Agaunico Mine located along structures that extended southward onto the

Teledyne property. The Company completed a total of 11 diamond drill holes

totaling 2,200 m in the fall of 2017. The drilling has confirmed cobalt

mineralization present on the Property which is consistent with historical

grades as reported historically by Cunningham-Dunlop (1979) and Bressee (1981),

disclosed in earlier news releases. These reports are available in the public

domain through MNDM's AFRI database.

NI 43-101 Reports for both the Teledyne and Glencore Bucke Properties, are

publicly available on http://www.SEDAR.com as well as the Company's website.

LiCo's recently completed diamond drilling program (September to December 2017)

consisted of both twinning and infill drilling of the historical drill holes

located on both the Teledyne Cobalt and Glencore Bucke Properties.

Purickuta Lithium Project (Chile):

The Purickuta Project is located within Salar de Atacama, a salt flat

encompassing 3,000 km2, being about 100 km long, 80 km wide and home to

approximately 37% of the worlds Lithium production and Chile itself holds 53% of

the world's known lithium reserves (Source: Bloomberg Markets - June 23, 2017,

"Lithium Squeeze Looms as Top Miner Front-Loads, Chile Says"). The property is

160 hectares large and is enveloped by a concession owned by Sociedad Quimica y

Minera ("SQM") and lies within a few kilometers of a property owned by CORFO

(the Chilean Economic Development Agency) where its leases land to both SQM and

Albermarle's Rockwood Lithium Corp. ("Albermarle") for lithium extraction.

Together these two companies, SQM and Albermarle, have a combined annual

production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) making up

100% of Chile's current lithium output. As reported in The Economist (June 15,

2017 - A battle for supremacy in the lithium triangle), the Salar de Atacama has

the largest and highest quality proven reserves of lithium. The combination of

the desert's hot sun, scarce rainfall, and the mineral-rich brines make Chile's

production costs the world's lowest. This together with a favourable investment

climate, low levels of corruption, and the quality of its bureaucracy and courts

makes Chile a favourable place to conduct business.

Dixie Valley Lithium Project (Nevada, USA):

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a

large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley,

Nevada. Some important geological similarities exist between various lithium

brines, notably geothermal activity, a dry climate, a closed basin, an aquifer,

and tectonically driven subsistence exist at Dixie Valley along with Clayton

Valley and various lithium bearing salars in Chile, Argentina and Bolivia.

Black Rock Desert Lithium Project (Nevada, USA):

The Company has entered into an option agreement whereby the Company may earn an

undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium

Project in southwest Black Rock Desert, Washoe County, Nevada.

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are

not limited to, comments that involve future events and conditions, which are

subject to various risks and uncertainties. Except for statements of historical

facts, comments that address resource potential, upcoming work programs,

geological interpretations, receipt and security of mineral property titles,

availability of funds, and others are forward-looking. Forward-looking

statements are not guarantees of future performance and actual results may vary

materially from those statements. General business conditions are factors that

could cause actual results to vary materially from forward-looking statements.

Contact:

Phone: +1(236)521-0207

LiCoEnergyMetals.com

SOURCE LiCo Energy Metals Inc.

LiCo Energy Metals - Summary of the Glencore Bucke Property Phase 1 Diamond Drilling Program

Vancouver, British Columbia --January 26, 2018 -- LiCo Energy Metals

Inc. (OTCQB: WCTXF)

(TSX-V: LIC)

("the Company" or "LiCo") is pleased to the update its

shareholders on the completion on the Glencore Bucke Property Phase 1 diamond

drilling program. During the fall of 2017, LiCo completed 21 diamond drill holes

totaling 1,900 m. This drill program, along with the Phase 1 diamond drilling

program completed on the Teledyne Cobalt Property, satisfied LiCo’s flow-through

financing obligations. The exploration program at the Glencore Bucke Property

also satisfied our contractual obligations to Glencore plc. whereby LiCo was to

incur $250,000 of exploration expenditures on the Property within six months of

t he

approval date (see News Release dated September 5th, 2017).

he

approval date (see News Release dated September 5th, 2017).

In 1981, Teledyne Canada Ltd., completed 36 surface diamond drill holes totaling

3,323 m. The drill program outlined two separate vein systems hosting

significant cobalt and silver values, known as the Main Zone, measuring 152.4 m

in length, and the Northwest Zone, measuring 70.0 m in length (Bresee, 1982).

LiCo’s Phase 1 diamond drill program was designed to confirm and extend the

existing known mineralization along strike and up and down dip, and LiCo was

successful in completing this objective. The program tested the Main Zone for a

strike length of approximately 55 m and the Northwest Zone for a strike length

of approximately 45 m. Due to the nature of the mineralization, drill holes were

closely spaced apart, generally at 10 m along sections, and 12.5 m between

sections on average. Significant cobalt intersections include diamond drill hole

GB17-10 that intersected 0.55% Co over 5.00 m from 28.00 to 33.00 m, and diamond

drill hole GB17-15 that intersected 8.42% Co over 0.30 m from 62.40 to 62.70 m.

Significant copper mineralization was also intersected, such as 0.90% Cu over

20.20 m from 42.50 to 62.70 m in diamond drill hole GB17-15, and 1.25% Cu over

6.10 m from 67.50 to 73.60 m in diamond drill hole GB17-21. The aforementioned

intervals represent core lengths, and not true widths.

“We are very pleased with the results of the Glencore Bucke Phase 1 drill

program, “commented Tim Fernback, LiCo President and CEO. “We not only were

successful in completing the objective of the drill program but also with the

overall grade, width and consistency of the mineralization. We are working on

the design and amount of metres to be drilled of the Phase 2 drill program which

will then be the basis of completing a 43-101 compliant resource estimation,

which will be completed in conjunction with the Teledyne Cobalt Project”.

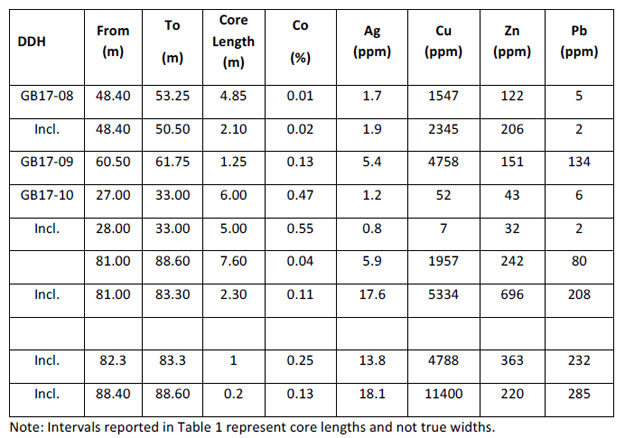

A summary of the most significant results from the Phase 1 diamond drilling

program are provided in Table 1, while drill hole collar information is provided

in Table 2.

Table 1: Highlights of Phase 1 Diamond Drilling Results, Glencore Bucke Property

|

DDH |

From (m) |

To (m) |

Core length (m) |

Co (%) |

Ag (ppm) |

Cu (ppm) |

Zn (ppm) |

Pb (ppm) |

|

GB17-01 |

18.00 |

21.00 |

3.00 |

0.31 |

1.5 |

41 |

27 |

4 |

|

GB17-02 |

39.37 |

39.67 |

0.30 |

0.42 |

707 |

2100 |

136 |

21900 |

|

GB17-03 |

27.15 |

28.90 |

1.75 |

0.27 |

0.6 |

4 |

27 |

2 |

|

GB17-03 |

31.25 |

31.5 |

0.25 |

0.39 |

6.3 |

619 |

33 |

27 |

|

GB17-03 |

38.50 |

41.00 |

2.50 |

0.03 |

12.2 |

10251 |

204 |

689 |

|

GB17-04 |

16.25 |

16.75 |

0.50 |

1.62 |

7 |

994 |

3493 |

28 |

|

GB17-06 |

22.50 |

24.25 |

1.75 |

0.25 |

12 |

288 |

132 |

6 |

|

incl. |

23.25 |

23.75 |

0.50 |

0.58 |

28.9 |

714 |

39 |

6 |

|

GB17-06 |

44.40 |

44.70 |

0.30 |

4.45 |

34.2 |

460 |

2600 |

159 |

|

GB17-07 |

99.79 |

100.05 |

0.26 |

7.64 |

9.1 |

441 |

44 |

16 |

|

GB17-10 |

28.00 |

33.00 |

5.00 |

0.55 |

0.8 |

7 |

32 |

2 |

|

GB17-10 |

81.00 |

83.30 |

2.30 |

0.11 |

17.6 |

5334 |

696 |

208 |

|

GB17-13 |

77.60 |

78.50 |

0.90 |

0.46 |

132.5 |

14614 |

1759 |

2059 |

|

incl. |

77.60 |

78.00 |

0.40 |

0.79 |

221 |

24000 |

3670 |

3840 |

|

GB17-13 |

100.50 |

102.00 |

1.50 |

0.32 |

98.8 |

8124 |

417 |

6588 |

|

incl. |

100.80 |

101.40 |

0.60 |

0.55 |

16.9 |

4970 |

376 |

6110 |

|

GB17-15 |

27.50 |

28.40 |

0.90 |

0.55 |

2.1 |

29 |

126 |

18 |

|

incl. |

27.80 |

28.10 |

0.30 |

0.92 |

2.9 |

40 |

208 |

29 |

|

GB17-15 |

42.50 |

62.70 |

20.20 |

0.17 |

19.9 |

8983 |

2638 |

4747 |

|

incl. |

62.40 |

62.70 |

0.30 |

8.42 |

136 |

1280 |

884 |

447 |

|

GB17-18 |

80.10 |

81.00 |

0.90 |

0.43 |

86.8 |

5177 |

133 |

662 |

|

GB17-19 |

46.00 |

46.60 |

0.60 |

0.75 |

111.1 |

689 |

44 |

6745 |

|

incl. |

46.00 |

46.30 |

0.30 |

1.33 |

208 |

1210 |

59 |

12400 |

|

GB17-20 |

60.25 |

64.30 |

4.05 |

0.44 |

19.4 |

9863 |

116 |

30 |

|

incl. |

62.80 |

64.00 |

1.20 |

1.42 |

48.8 |

19362 |

127 |

60 |

|

GB17-21 |

67.50 |

73.60 |

6.10 |

0.08 |

18.1 |

12545 |

378 |

463 |

|

incl. |

69.70 |

70.30 |

0.60 |

0.73 |

50 |

13070 |

312 |

378 |

Note: Intervals reported in Table 1 represent core lengths and not true widths.

Table 2: Drill hole Collar Information

|

DDH |

Azm |

Dip |

|

GB17-01 |

270 |

-45 |

|

GB17-02 |

270 |

-45 |

|

GB17-03 |

270 |

-45 |

|

GB17-04 |

270 |

-45 |

|

GB17-05 |

270 |

-45 |

|

GB17-06 |

270 |

-45 |

|

GB17-07 |

270 |

-45 |

|

GB17-08 |

270 |

-45 |

|

GB17-09 |

270 |

-45 |

|

GB17-10 |

270 |

-45 |

|

GB17-11 |

270 |

-45 |

|

GB17-12 |

270 |

-45 |

|

GB17-13 |

270 |

-45 |

|

GB17-14 |

270 |

-60 |

|

GB17-15 |

270 |

-45 |

|

GB17-16 |

270 |

-45 |

|

GB17-17 |

270 |

-60 |

|

GB17-18 |

270 |

-45 |

|

GB17-19 |

270 |

-45 |

|

GB17-20 |

270 |

-45 |

|

GB17-21 |

270 |

-52 |

Once the final assay results are received from

the Teledyne Cobalt Project, LiCo will evaluate the results, along with the

results from the Glencore Bucke Property, to develop a 2018 Phase 2 diamond

drilling program for each Property.

QA/QC Program

LiCo Energy Metals Inc. has implemented a quality assurance/quality control

(QA/QC) program for both the Glencore Bucke and Teledyne Property drill

programs.

Diamond drill core was logged, then sawed in half, with one half placed in a

labelled bag, and the remaining half placed back into the core box and stored in

a secured compound. Either a standard or a blank was inserted every 20th sample.

All samples were shipped to Activation Laboratories in Ancaster, Ontario. Each

sample is coarsely crushed and a 250 g aliquot is pulverized for analysis. A

0.25g sample is digested with a near total digestion (4 acids) and then analyzed

using an ICP. QC for the digestion is 14% for each batch, 5 method reagent

blanks, 10 in-house controls, 10 samples duplicates, and 8 certified reference

materials. An additional 13% QC is performed as part of the instrumental

analysis to ensure quality in the areas of instrumental drift. If over limits

for Cu, Pb, Zn, and Co are encountered, a sodium peroxide fusion, acid

dissolution followed by ICP‐OES is completed. For Ag over limits, a four acid

digestion is completed followed by ICP‐OES.

Qualified Person

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

About LiCo Energy Metals: https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary

listing is on the TSX Venture Exchange. The Company's focus is directed towards

exploration for high value metals integral to the manufacture of lithium ion

batteries.

Glencore Bucke Cobalt Project, Cobalt, Ontario: The Company has entered into a

property purchase agreement to acquire a 100% interest from Glencore Canada

Corporation (subsidiary of Glencore plc) in the Glencore Bucke Property,

situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario, subject to a

back-in provision, production royalty and off-take agreement. Strategically, the

Glencore Bucke Property consists of 16.2 hectares and sits along the west

boundary of LiCo’s Teledyne Cobalt Project. The Property covers the southern

extension of the #3 vein that was historically mined on the neighbouring Cobalt

Contact Property located to the north of the Glencore Bucke Property. Diamond

drilling in 1981 on the Glencore Bucke Property delineated two zones of

mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project:

The Company has an option to earn 100% ownership, subject to a royalty, in the

Teledyne Project located near Cobal t.

Ontario. The Property adjoins the south and west boundaries of claims that

hosted the Agaunico Mine. From 1905 through to 1961, the Agaunico Mine produced

a total of 4,350,000 lbs. of cobalt and 980,000 oz. of silver. A significant

portion of the cobalt that was produced at the Agaunico Mine located along

structures that extended southward onto the Teledyne property. The Company

completed a total of 11 diamond drill holes totaling 2,200 m in the fall of

2017. The drilling has confirmed cobalt mineralization present on the Property

which is consistent with historical grades as reported historically by

Cunningham-Dunlop (1979) and Bressee (1981), disclosed in earlier news releases.

These reports are available in the public domain through MNDM’s AFRI database.

t.

Ontario. The Property adjoins the south and west boundaries of claims that

hosted the Agaunico Mine. From 1905 through to 1961, the Agaunico Mine produced

a total of 4,350,000 lbs. of cobalt and 980,000 oz. of silver. A significant

portion of the cobalt that was produced at the Agaunico Mine located along

structures that extended southward onto the Teledyne property. The Company

completed a total of 11 diamond drill holes totaling 2,200 m in the fall of

2017. The drilling has confirmed cobalt mineralization present on the Property

which is consistent with historical grades as reported historically by

Cunningham-Dunlop (1979) and Bressee (1981), disclosed in earlier news releases.

These reports are available in the public domain through MNDM’s AFRI database.

NI 43-101 Reports for both the Teledyne and Glencore Bucke Properties, are

publicly available on www.SEDAR.com as well as the Company’s website. LiCo’s

recently completed diamond drilling program (September to December 2017)

consisted of both twinning and infill drilling of the historical drill holes

located on both the Teledyne Cobalt and Glencore Bucke Properties.

Chile Purickuta Lithium Project:

The Purickuta Project is located within Salar de Atacama, a salt flat

encompassing 3,000 km2, being about 100 km long, 80 km wide and home to

approximately 37% of the worlds Lithium production and Chile itself holds 53% of

the world’s known lithium reserves (Source: Bloomberg Markets – June 23, 2017,

“Lithium Squeeze Looms as Top Miner Front-Loads, Chile Says”). The property is

160 hectares large and is enveloped by a concession owned by Sociedad Quimica y

Minera (“SQM”) and lies within a few kilometers of a property owned by CORFO

(the Chilean Economic Development Agency) where its leases land to both SQM and

Albermarle’s Rockwood Lithium Corp. (“Albermarle”) for lithium extraction.

Together these two companies, SQM and Albermarle, have a combined annual

production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) making up

100% of Chile’s current lithium output. As reported in The Economist (June 15,

2017 – A battle for supremacy in the lithium triangle), the Salar de Atacama has

the largest and highest quality proven reserves of lithium. The combination of

the desert’s hot sun, scarce rainfall, and the mineral-rich brines make Chile’s

production costs the world’s lowest. This together with a favourable investment

climate, low levels of corruption, and the quality of its bureaucracy and courts

makes Chile a favourable place to conduct business.

Nevada Dixie Valley Lithium Project:

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a

large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley,

Nevada. Some important geological similarities exist between various lithium

brines, notably geothermal activity, a dry climate, a closed basin, an aquifer,

and tectonically driven subsistence exist at Dixie Valley along with Clayton

Valley and various lithium bearing salars in Chile, Argentina and Bolivia.

Nevada Black Rock Desert Lithium Project:

The Company has entered into an option agreement whereby the Company may earn an

undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium

Project in southwest Black Rock Desert, Washoe County, Nevada.

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are

not limited to, comments that involve future events and conditions, which are

subject to various risks and uncertainties. Except for statements of historical

facts, comments that address resource potential, upcoming work programs,

geological interpretations, receipt and security of mineral property titles,

availability of funds, and others are forward-looking. Forward-looking

statements are not guarantees of future performance and actual results may vary

materially from those statements. General business conditions are factors that

could cause actual results to vary materially from forward-looking statements.

Contact:

Phone: +1(236)521-0207

LiCoEnergyMetals.com

SOURCE LiCo Energy Metals Inc.

LiCo Energy Metals - Intersects 21.9 % Cobalt Over 0.36 m and 18.7 % Cobalt Over

0.15 m at Teledyne Cobalt Property

Vancouver, British Columbia --January 24, 2018 -- LiCo Energy Metals

Inc. (OTCQB: WCTXF)

(TSX-V: LIC)

("the Company" or "LiCo") is pleased to report assay results for

drill holes TE17-04 and TE17-05 completed on the Teledyne Cobalt Property,

located 6 km northeast of Cobalt, Ontario. The current drill program was

designed to confirm and extend the existing known mineralization along strike

and up and down dip.

A summary of the most significant results of the recent drill core assays

are:

- TE17-05 2.32% Co over 4.00 m from 126.5 to 130.50 m,

including 21.9% Co over 0.36 m from 127.64 to 128.00 m

- TE17-04 1.82% Co over 6.00 m from 138.00 to 144.00 m, including 5.06% Co over

1.75 m from 141.25 to 143.00 m, and 18.70% Co over 0.15 m from 141.64 to 141.79

m.

- TE17-05 1.70% Co over 6.00 m from 136.00 to 142.00 m.

"LiCo is very encouraged by these higher-grade results for the Teledyne Cobalt

Project," says Tim Fernback, President & CEO of LiCo. "These are the highest

grade results that have been intersected to date on either LiCo's Teledyne or

Glencore-Bucke Properties that LiCo has drill tested to date."

On the Teledyne Cobalt Property, the Company completed a total of 11 diamond

drill holes totaling 2,200 m in the fall of 2017.

The results and drill hole collar information for diamond drill holes TE17-04 to

TE17-05 are summarized in Tables 1 & 2 below.

Table 1: Drill hole Collar Information

DDH Azm Dip

TE17-04 090 -45

TE17-05 090 -45

Table 2: Summary of Diamond Drill Results

Core

To Length Co Ag Cu Zn Pb

DDH From (m) (m) (m) (%) (ppm) (ppm) (ppm) (ppm)

TE17-04 138.00 144.00 6.00 1.82 4.7 742 49 20

incl. 138.50 144.00 5.50 1.98 5 786 51 21

incl. 139.00 144.00 5.00 2.16 5.4 840 53 23

incl. 140.45 143.00 2.55 3.84 8 1242 67 33

incl. 141.25 143.00 1.75 5.06 9.1 744 85 36

incl. 141.64 141.79 0.15 18.70 16 251 6 37

TE17-05 126.50 130.50 4.00 2.32 7.6 425 49 61

incl. 127.00 128.00 1.00 8.48 5.6 105 25 24

incl. 127.00 129.00 2.00 4.47 7.1 263 28 50

incl. 127.64 128.00 0.36 21.9 11.5 42 31 36

TE17-05 136.00 142.00 6.00 1.70 2.6 40 148 28

incl. 136.00 140.00 4.00 2.47 2.8 34 210 33

incl. 136.50 138.5 2.00 4.41 3.7 30 141 46

Note: Intervals reported in Table 2 represent core lengths and

not true widths.

QA/QC Program

LiCo Energy Metals Inc. has implemented a quality assurance/quality control

(QA/QC) program for Teledyne Cobalt Property Phase 1 diamond drilling program.

Diamond drill core was logged, then sawed in half, with one half placed in a

labeled bag, and the remaining half placed back into the core box and stored in

a secured compound. Either a standard or a blank was inserted every 20th sample.

All samples were shipped to Activation Laboratories in Ancaster, Ontario. Each

sample is coarsely crushed and a 250 g aliquot is pulverized for analysis. A

0.25g sample is digested with a near total digestion (4 acids) and then analyzed

using an ICP. QC for the digestion is 14% for each batch, 5 method reagent

blanks, 10 in-house controls, 10 samples duplicates, and 8 certified reference

materials. An additional 13% QC is performed as part of the instrumental

analysis to ensure quality in the areas of instrumental drift. If over limits

for Cu, Pb, Zn, and Co are encountered, a sodium peroxide fusion, acid

dissolution followed by ICP‐OES is completed. For Ag over limits, a four-acid

digestion is completed followed by ICP‐OES.

Qualified Person

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

About LiCo Energy Metals: https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary

listing is on the TSX Venture Exchange. The Company's focus is directed towards

exploration for high value metals integral to the manufacture of lithium ion

batteries.

Glencore Bucke Cobalt Project, Cobalt, Ontario: The Company has entered into a

property purchase agreement to acquire a 100% interest from Glencore Canada

Corporation (subsidiary of Glencore plc) in the Glencore Bucke Property,

situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario, subject to a

back-in provision, production royalty and off-take agreement. Strategically, the

Glencore Bucke Property consists of 16.2 hectares and sits along the west

boundary of LiCo's Teledyne Cobalt Project. The Property covers the southern

extension of the #3 vein that was historically mined on the neighbouring Cobalt

Contact Property located to the north of the Glencore Bucke Property. Diamond

drilling in 1981 on the Glencore Bucke Property delineated two zones of

mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project:

The Company has an option to earn 100% ownership, subject to a royalty, in the

Teledyne Project located near Cobalt. Ontario. The Property adjoins the south

and west boundaries of claims that hosted the Agaunico Mine. From 1905 through

to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and

980,000 oz. of silver. A significant portion of the cobalt that was produced at

the Agaunico Mine located along structures that extended southward onto the

Teledyne property. The Company completed a total of 11 diamond drill holes

totaling 2,200 m in the fall of 2017. The drilling has confirmed cobalt

mineralization present on the Property which is consistent with historical

grades as reported historically by Cunningham-Dunlop (1979) and Bressee (1981),

disclosed in earlier news releases. These reports are available in the public

domain through MNDM's AFRI database.

NI 43-101 Reports for both the Teledyne and Glencore Bucke Properties, are

publicly available on http://www.SEDAR.com as well as the Company's website.

LiCo's recently completed diamond drilling program (September to December 2017)

consisted of both twinning and infill drilling of the historical drill holes

located on both the Teledyne Cobalt and Glencore Bucke Properties.

Chile Purickuta Lithium Project:

The Purickuta Project is located within Salar de Atacama, a salt flat

encompassing 3,000 km2, being about 100 km long, 80 km wide and home to

approximately 37% of the worlds Lithium production and Chile itself holds 53% of

the world's known lithium reserves (Source: Bloomberg Markets - June 23, 2017,

"Lithium Squeeze Looms as Top Miner Front-Loads, Chile Says") . The property is

160 hectares large and is enveloped by a concession owned by Sociedad Quimica y

Minera ("SQM") and lies within a few kilometers of a property owned by CORFO

(the Chilean Economic Development Agency) where its leases land to both SQM and

Albermarle's Rockwood Lithium Corp. ("Albermarle") for lithium extraction.

Together these two companies, SQM and Albermarle, have a combined annual

production of over 62,000 tonnes of LCE (Lithium Carbonate Equivalent) making up

100% of Chile's current lithium output. As reported in The Economist (June 15,

2017 - A battle for supremacy in the lithium triangle), the Salar de Atacama has

the largest and highest quality proven reserves of lithium. The combination of

the desert's hot sun, scarce rainfall, and the mineral-rich brines make Chile's

production costs the world's lowest. This together with a favourable investment

climate, low levels of corruption, and the quality of its bureaucracy and courts

makes Chile a favourable place to conduct business.

Nevada Dixie Valley Lithium Project:

The Company has an option to acquire a 100% interest, subject to a 3% NSR, on a

large lithium exploration project at the Humboldt Salt Marsh in Dixie Valley,

Nevada. Some important geological similarities exist between various lithium

brines, notably geothermal activity, a dry climate, a closed basin, an aquifer,

and tectonically driven subsistence exist at Dixie Valley along with Clayton

Valley and various lithium bearing salars in Chile, Argentina and Bolivia.

Nevada Black Rock Desert Lithium Project:

The Company has entered into an option agreement whereby the Company may earn an

undivided 100% interest, subject to a 3% NSR, in the Black Rock Desert Lithium

Project in southwest Black Rock Desert, Washoe County, Nevada.

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

On Behalf of the Board of Directors

Tim Fernback, President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

This news release may contain forward-looking statements which include, but are

not limited to, comments that involve future events and conditions, which are

subject to various risks and uncertainties. Except for statements of historical

facts, comments that address resource potential, upcoming work programs,

geological interpretations, receipt and security of mineral property titles,

availability of funds, and others are forward-looking. Forward-looking

statements are not guarantees of future performance and actual results may vary

materially from those statements. General business conditions are factors that

could cause actual results to vary materially from forward-looking statements.

Contact:

Phone: +1(236)521-0207

LiCoEnergyMetals.com

SOURCE LiCo Energy Metals Inc.

LiCo Energy Metals - Intersects 8.42% Co Over 0.30 Metres on the Glencore Bucke Property

Vancouver, British Columbia --January 17, 2018 -- LiCo Energy Metals

Inc. (OTCQB: WCTXF)

(TSX-V: LIC)

("the Company" or "LiCo") is pleased to the report assay results

for drill holes GB17-15 through to GB17-19, completed on the Glencore Bucke

Property, located 6 km northeast of Cobalt, Ontario. The current drill program

was designed to confirm and extend the existing known mineralization along

strike and up and down dip and LiCo was successful in completing this objective.

A summary of the most significant results of the recent drill core assays are:

- GB17-15 0.17 % Co, 19.9 ppm Ag, and 0.90% Cu over 20.20 m from 42.50 to

62.70 m, including 8.42 % Co, 136 ppm Ag over 0.30 m from 62.40 to 62.70 m

- GB17-15 0.55 % Co over 0.90 m from 27.50 to 28.40 m, including 0.92 % Co over

0.30 m from 27.80 to 28.10 m

- GB17-18 0.43 % Co, 86.8 ppm Ag, 0.52% Cu over 0.90 m from 80.10 to 81.00 m

- GB17-19 0.75 % Co, 111.1 ppm Ag over 0.60 m from 46.00 to 46.60 m, including

1.33 % Co, 208 ppm Ag over 0.30 m from 46.00 to 46.30 m

"We have consistently seen higher grade cobalt mineralization being intersected

throughout the drilling completed at Glencore Bucke," says Tim Fernback,

President & CEO of LiCo. "Along with the cobalt, appreciable copper values have

been intersected over larger intervals such as 0.90 % over 20.20 m. These

additional base metal zones that have been reported over the last several months

were not expected."

On the Glencore Bucke Property, the Company has completed a total of 21 diamond

drill holes totaling 1,900 m, testing the Main and Northwest zones. The final

assay results for the Glencore Bucke Property have been released, however, the

Company will continue to release drill results from the Teledyne Cobalt Property

as they are received.

The results and drill hole collar information for diamond drill holes GB17-15

through to GB17-19 are summarized in Tables 1 & 2 below.

Table 1: Summary of Diamond Drill Results

|

DDH

|

From (m)

|

To (m)

|

Core Length (m) |

Co (%)

|

Ag (ppm)

|

Cu (ppm)

|

Zn (ppm)

|

Pb (ppm)

|

|

GB17-15 |

22.65 |

23.05 |

0.40 |

0.23 |

1.7 |

66 |

41 |

2 |

|

GB17-15 |

27.50 |

28.40 |

0.90 |

0.55 |

2.1 |

29 |

126 |

18 |

|

incl. |

27.80 |

28.10 |

0.30 |

0.92 |

2.9 |

40 |

208 |

29 |

|

GB17-15 |

42.50 |

62.70 |

20.20 |

0.17 |

19.9 |

8983 |

2638 |

4747 |

|

incl. |

45.30 |

45.60 |

0.30 |

0.37 |

27.4 |

9100 |

135 |

4440 |

|

incl. |

54.00 |

54.30 |

0.30 |

0.21 |

9.9 |

5370 |

148 |

114 |

|

incl. |

55.80 |

57.50 |

1.70 |

0.22 |

32.1 |

18797 |

268 |

103 |

|

incl. |

56.30 |

56.70 |

0.40 |

0.48 |

67.6 |

40500 |

271 |

164 |

|

incl. |

62.40 |

62.70 |

0.30 |

8.42 |

136 |

1280 |

884 |

447 |

|

GB17-15 |

72.00 |

72.50 |

0.50 |

0.12 |

9.9 |

7650 |

2430 |

738 |

|

GB17-16 |

34.50 |

35.50 |

1.00 |

0.27 |

1 |

4 |

81 |

7 |

|

GB17-16 |

83.40 |

83.70 |

0.30 |

0.15 |

26 |

4190 |

300 |

513 |

|

GB17-16 |

89.40 |

90.00 |

0.60 |

0.01 |

6.8 |

7990 |

729 |

770 |

|

GB17-16 |

92.00 |

93.90 |

1.90 |

0.00 |

4.3 |

280 |

9768 |

2924 |

|

incl. |

92.00 |

93.00 |

1.00 |

0.00 |

5.1 |

245 |

13720 |

4532 |

|

GB17-17 |

34.70 |

35.50 |

0.80 |

0.20 |

1 |

92 |

40 |

4 |

|

GB17-17 |

42.80 |

51.80 |

9.00 |

0.02 |

4.7 |

5118 |

358 |

118 |

|

incl. |

44.60 |

49.00 |

4.40 |

0.02 |

6.9 |

7763 |

171 |

54 |

|

incl. |

45.00 |

45.60 |

0.60 |

0.01 |

12.8 |

22450 |

134 |

8 |

|

GB17-18 |

76.50 |

82.00 |

5.50 |

0.11 |

25.9 |

6567 |

1812 |

4795 |

|

incl. |

78.30 |

81.00 |

2.70 |

0.23 |

37 |

7411 |

283 |

566 |

|

incl. |

79.80 |

81.00 |

1.20 |

0.38 |

66.6 |

5228 |

134 |

523 |

|

incl. |

80.10 |

81.00 |

0.90 |

0.43 |

86.8 |

5177 |

133 |

662 |

|

GB17-19 |

37.70 |

38.10 |

0.40 |

0.11 |

0.2 |

18 |

46 |

2 |

|

GB17-19 |

44.50 |

47.40 |

2.90 |

0.16 |

24.9 |

2981 |

62 |

1421 |

|

incl. |

46.00 |

46.60 |

0.60 |

0.75 |

111.1 |

689 |

44 |

6745 |

|

incl. |

46.00 |

46.30 |

0.30 |

1.33 |

208 |

1210 |

59 |

12400 |

|

GB17-19 |

47.40 |

47.80 |

0.40 |

0.30 |

5.4 |

392 |

59 |

179 |

|

GB17-19 |

46.00 |

51.00 |

5.00 |

0.16 |

15.6 |

1271 |

54 |

882 |

|

incl. |

50.50 |

51.00 |

0.50 |

0.28 |

5.6 |

77 |

55 |

216 |

|

GB17-19 |

90.00 |

93.00 |

3.00 |

0.05 |

15.9 |

6456 |

830 |

615 |

|

incl. |

91.30 |

91.60 |

0.30 |

0.38 |

49.2 |

17100 |

88 |

410 |

Note: Intervals reported in Table 1 represent core lengths and not true widths.

Table 2: Drill hole Collar Information

|

DDH |

Azm |

Dip |

|

GB17-15 |

270 |

-45 |

|

GB17-16 |

270 |

-45 |

|

GB17-17 |

270 |

-60 |

|

GB17-18 |

270 |

-45 |

|

GB17-19 |

270 |

-45 |

"As reported on the Company's November 30th, 2017 news release,

LiCo has recently completed its 2017 diamond drilling program on its Teledyne

and Glencore Bucke Properties completing a total of 32 diamond drill holes,

drilling 4,100 m of core. This exploration work satisfies both its flow-through

financing obligations and the contractual obligations outlined in the recently

acquired Glencore Bucke Property from Glencore plc of Baar Switzerland (LSE:

GLEN).

LiCo Energy Metals Inc. has implemented a quality assurance/quality control

(QA/QC) program for both the Glencore Bucke and Teledyne Property drill

programs.

Diamond drill core was logged, then sawed in half, with one half placed in a

labelled bag, and the remaining half placed back into the core box and stored in

a secured compound. Either a standard or a blank was inserted every 20th sample.

All samples were shipped to Activation Laboratories in Ancaster, Ontario. Each

sample is coarsely crushed and a 250 g aliquot is pulverized for analysis. A

0.25g sample is digested with a near total digestion (4 acids) and then analyzed

using an ICP. QC for the digestion is 14% for each batch, 5 method reagent

blanks, 10 in-house controls, 10 samples duplicates, and 8 certified reference

materials. An additional 13% QC is performed as part of the instrumental

analysis to ensure quality in the areas of instrumental drift. If over limits

for Cu, Pb, Zn, and Co are encountered, a sodium peroxide fusion, acid

dissolution followed by ICP‐OES is completed. For Ag over limits, a four acid

digestion is completed followed by ICP‐OES.

Qualified Person

The technical content of this news release has been reviewed and approved Joerg

Kleinboeck, P.Geo., an independent consulting geologist and a qualified person

as defined in NI 43-101.

About LiCo Energy Metals: https://licoenergymetals.com/

LiCo Energy Metals Inc. is a Canadian based exploration company whose primary

listing is on the TSX Venture Exchange. The Company's focus is directed towards

exploration for high value metals integral to the manufacture of lithium ion

batteries.

Glencore Bucke Cobalt Project, Cobalt, Ontario: The Company has entered into a

property purchase agreement to acquire a 100% interest from Glencore Canada

Corporation (subsidiary of Glencore plc) in the Glencore Bucke Property,

situated in Bucke Township, 6 km east-northeast of Cobalt, Ontario, subject to a

back-in provision, production royalty and off-take agreement. Strategically, the

Glencore Bucke Property consists of 16.2 hectares and sits along the west

boundary of LiCo's Teledyne Cobalt Project. The Property covers the southern

extension of the #3 vein that was historically mined on the neighbouring Cobalt

Contact Property located to the north of the Glencore Bucke Property. Diamond

drilling in 1981 on the Glencore Bucke Property delineated two zones of

mineralization measuring 150 m and 70 m in length.

Ontario Teledyne Cobalt Project:

The Company has an option to earn 100% ownership, subject to a royalty, in the

Teledyne Project located near Cobalt. Ontario. The Property adjoins the south

and west boundaries of claims that hosted the Agaunico Mine. From 1905 through

to 1961, the Agaunico Mine produced a total of 4,350,000 lbs. of cobalt and

980,000 oz. of silver. A significant portion of the cobalt that was produced at

the Agaunico Mine located along structures that extended southward onto the

Teledyne property. The Company completed a total of 11 diamond drill holes

totaling 2,200 m in the fall of 2017. The drilling has confirmed cobalt

mineralization present on the Property which is consistent with historical

grades as reported historically by Cunningham-Dunlop (1979) and Bressee (1981),

disclosed in earlier news releases. These reports are available in the public

domain through MNDM's AFRI database.

NI 43-101 Reports for both the Teledyne and Glencore Bucke Properties, are

publicly available on www.SEDAR.com as well as the Company's website. LiCo's

recently completed diamond drilling program (September to December 2017)

consisted of both twinning and infill drilling of the historical drill holes

located on both the Teledyne Cobalt and Glencore Bucke Properties.

Chile Purickuta Lithium Project:

The Purickuta Project is located within Salar de Atacama, a salt flat

encompassing 3,000 km2, being about 100 km long, 80 km wide and home to

approximately 37% of the worlds Lithium production and Chile itself holds 53% of

the world's known lithium reserves (Source: Bloomberg Markets – June 23, 2017,

"Lithium Squeeze Looms as Top Miner Front-Loads, Chile Says"). The property is

160 hectares large and is enveloped by a concession owned by Sociedad Quimica y

Minera ("SQM") and lies within a few kilometers of a property owned by CORFO

(the Chilean Economic Development Agency) where its leases land to both SQM and

Albermarle's Rockwood Lithium Corp. ("Albermarle") for lithium extraction.